You are here:Aicha Vitalis > news

Can You Buy Bitcoin in Your IRA?

Aicha Vitalis2024-09-20 23:49:08【news】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being one of airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being one of

In recent years, the cryptocurrency market has seen a surge in popularity, with Bitcoin being one of the most prominent digital currencies. As investors look for new ways to diversify their portfolios, many are wondering if they can buy Bitcoin in their IRA. In this article, we will explore the possibility of purchasing Bitcoin within an IRA and the potential benefits and risks involved.

Firstly, it's important to understand what an IRA is. An IRA, or Individual Retirement Account, is a tax-advantaged savings account designed to help individuals save for retirement. There are two main types of IRAs: traditional and Roth. Traditional IRAs offer tax-deferred growth, meaning you won't pay taxes on the money until you withdraw it in retirement. Roth IRAs, on the other hand, offer tax-free growth, as long as you meet certain criteria for withdrawals.

Now, let's address the question: can you buy Bitcoin in your IRA? The answer is yes, you can. However, it's important to note that not all IRAs are created equal when it comes to cryptocurrency investments. Some IRA providers may offer a self-directed IRA, which allows you to invest in a wider range of assets, including Bitcoin and other cryptocurrencies.

To buy Bitcoin in your IRA, you will need to follow these steps:

1. Choose a self-directed IRA provider: Not all IRA providers offer the option to invest in cryptocurrencies. Look for a reputable provider that offers self-directed IRAs and supports cryptocurrency investments.

2. Roll over or transfer your existing IRA: If you already have an IRA, you may need to roll it over or transfer it to a self-directed IRA provider that allows cryptocurrency investments.

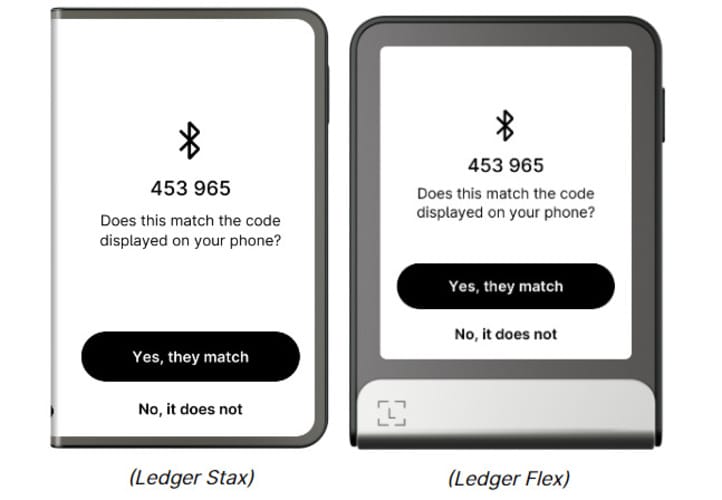

3. Open a cryptocurrency wallet: To store your Bitcoin, you will need a cryptocurrency wallet. There are various types of wallets available, including software wallets, hardware wallets, and paper wallets. Choose a wallet that suits your needs and ensure it is secure.

4. Purchase Bitcoin: Once your IRA is set up and you have a cryptocurrency wallet, you can purchase Bitcoin through your IRA provider. The process may vary depending on the provider, but generally, you will need to authorize a transfer of funds from your IRA to the provider, who will then purchase Bitcoin on your behalf.

5. Monitor your investment: As with any investment, it's important to keep an eye on your Bitcoin holdings within your IRA. Stay informed about market trends and consider consulting with a financial advisor if needed.

While buying Bitcoin in your IRA can offer potential benefits, it's crucial to be aware of the risks involved:

1. Market volatility: Cryptocurrency markets are known for their volatility, which can lead to significant price fluctuations. This volatility can be a double-edged sword, as it can result in both substantial gains and losses.

2. Security concerns: Storing cryptocurrencies securely is essential. If your wallet is compromised or hacked, you could lose your Bitcoin. Ensure you take appropriate measures to protect your digital assets.

3. Tax implications: While Bitcoin investments within an IRA can offer tax advantages, it's important to understand the tax implications of selling or transferring your Bitcoin in the future. Consult with a tax professional to ensure compliance with IRS regulations.

In conclusion, you can buy Bitcoin in your IRA, but it's essential to do so with caution and consider the potential risks and rewards. By carefully selecting a self-directed IRA provider, understanding the market, and staying informed, you can make informed decisions about incorporating Bitcoin into your retirement portfolio.

This article address:https://www.aichavitalis.com/blog/11c09199897.html

Like!(55)

Related Posts

- What is Bitcoin Cash Faucet?

- Info Binance Coin: A Comprehensive Guide to the Popular Cryptocurrency

- **Wallet Comparison: Bitcoin - A Comprehensive Overview

- Binance Spot Trading: A Comprehensive Guide to Trading Cryptocurrencies on the World's Leading Exchange

- Bitcoin Cash Fork Date: A Milestone in the Cryptocurrency World

- Top Bitcoin Wallets Holders: Who Are They and Why Are They So Important?

- Where is Bitcoin Wallet on Cash App?

- Bitcoin Cash Low Fees: A Game-Changer for Cryptocurrency Users

- Can You Buy Bitcoins with a Prepaid Credit Card?

- Where is Bitcoin Wallet on Cash App?

Popular

Recent

How to Hack Any Bitcoin Wallet: A Comprehensive Guide

Hashstar Bit Bitcoin Cloud Mining: A Comprehensive Guide to the Future of Cryptocurrency Investment

Binance, one of the leading cryptocurrency exchanges in the world, has gained a reputation for its user-friendly interface and robust trading platform. However, like any financial service, users often seek clarity on their transaction history, particularly when it comes to withdrawals. This article delves into the intricacies of the withdrawal record feature on Binance, explaining how it works and why it's crucial for users to keep track of their transactions.

How to Convert BNB to BTC on Binance: A Step-by-Step Guide

Bitcoin Mining Nuclear: A Controversial and Energy-Intensive Process

**Wallet Comparison: Bitcoin - A Comprehensive Overview

Why Does Bitcoin's Price Rise and Fall?

How to Convert BNB to BTC on Binance: A Step-by-Step Guide

links

- Binance Rose BTC: A Game-Changing Move in the Cryptocurrency Market

- Top 10 Free Bitcoin Mining Apps for Android: Unleash the Power of Cryptocurrency on Your Mobile Device

- Bitcoin Mining Kazakhstan: A Booming Industry in the Heart of Asia

- Example of Bitcoin Mining Math Problem: Understanding the Challenge

- How to Trade Bitcoin to Cash on Paxful: A Step-by-Step Guide

- Why Are Bitcoin Prices Dropping in November 2017?

- How Much BTC Does Binance Hold: A Comprehensive Analysis

- What is Binance Future Trading?

- **Bitcoin Cash SV IOU: A New Era of Digital Currencies

- Bitcoin Price on September 14, 2017: A Milestone in Cryptocurrency History