You are here:Aicha Vitalis > markets

Is Bitcoin Harder to Mine When Price Is Higher?

Aicha Vitalis2024-09-21 01:31:48【markets】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has been attracting attention from invest airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has been attracting attention from invest

Bitcoin, the world's first decentralized digital currency, has been attracting attention from investors and miners alike. As the price of Bitcoin continues to rise, many people are wondering whether it is harder to mine Bitcoin when the price is higher. In this article, we will explore this question and discuss the factors that affect the difficulty of mining Bitcoin.

Firstly, it is important to understand the concept of mining difficulty. Mining difficulty is a measure of how hard it is to find a new block in the Bitcoin network. The higher the difficulty, the more computational power is required to mine a new block. The difficulty of mining is adjusted every 2016 blocks, or approximately every two weeks, to maintain a consistent block generation time of 10 minutes.

When the price of Bitcoin is higher, it is generally easier to attract more miners to join the network. This is because higher prices mean higher rewards for miners. However, as more miners join the network, the total computational power of the network increases, which in turn raises the mining difficulty. Therefore, it is not necessarily true that mining Bitcoin is harder when the price is higher.

One of the main factors that affect mining difficulty is the number of miners in the network. When the price of Bitcoin rises, more people are likely to enter the mining market, increasing the total computational power of the network. As a result, the mining difficulty will also increase. Conversely, when the price of Bitcoin falls, some miners may leave the market, reducing the total computational power and lowering the mining difficulty.

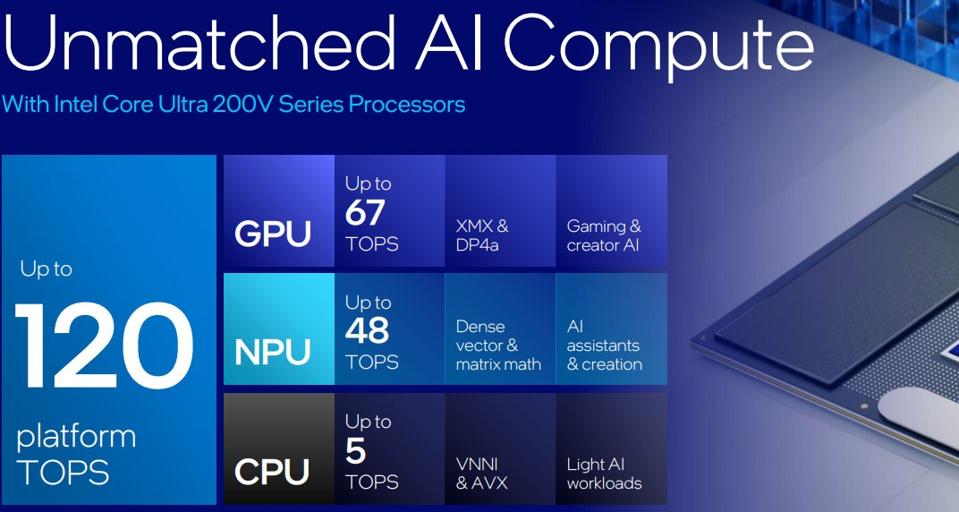

Another factor that affects mining difficulty is the efficiency of mining hardware. As technology advances, more efficient mining hardware is developed, which can mine Bitcoin faster and consume less electricity. When new and more efficient mining hardware is introduced, the mining difficulty may increase temporarily as miners upgrade their equipment. However, over time, the overall efficiency of the network will improve, and the mining difficulty will stabilize.

Moreover, the geographical distribution of miners also plays a role in mining difficulty. Miners in regions with cheaper electricity can operate more profitably, which attracts more miners to those areas. This can lead to a concentration of mining power in certain regions, affecting the overall mining difficulty.

In conclusion, while it may seem intuitive that mining Bitcoin is harder when the price is higher, the reality is more complex. The difficulty of mining Bitcoin is influenced by various factors, including the number of miners, the efficiency of mining hardware, and the geographical distribution of miners. When the price of Bitcoin rises, more miners are likely to join the network, which can lead to an increase in mining difficulty. However, the overall efficiency of the network and the geographical distribution of miners can also affect the mining difficulty. Therefore, it is essential to consider all these factors when evaluating the difficulty of mining Bitcoin.

This article address:https://www.aichavitalis.com/blog/18a5099931.html

Like!(9581)

Related Posts

- Unlocking the Potential of Binance with a 200 USDT Coupon

- Bitcoin Mining Today: The Current State and Future Prospects

- Mining Bitcoin in 2012 with AMD RX 280: A Look Back at the Early Days of Cryptocurrency Mining

- Is USDT on Binance Smart Chain: A Comprehensive Guide

- The Current Price of Bitcoin AUD: A Comprehensive Analysis

- Bitcoin Lower Price Ever: What It Means for the Cryptocurrency Market

- Buy Bitcoin with Prepaid Card Canada: A Comprehensive Guide

- How Much Does a Bitcoin Mining Machine Make?

- Bitcoin Price is Going Up: What You Need to Know

- The Current Status of Bitcoin Price USD: A Comprehensive Analysis

Popular

- The Role of a Senior Manager of Bitcoin Mining: A Key Player in the Cryptocurrency Industry

- How to Use Bitcoin Mining Rig: A Comprehensive Guide

- ### XRB Trading on Binance: A Comprehensive Guide to Buying and Selling RippleX (XRB) on the Leading Cryptocurrency Exchange

- Bitcoin January 2024 Price Prediction: What Experts Say

Recent

How to Mining Bitcoin Private: A Comprehensive Guide

In December 2021, the world of cryptocurrency saw a significant surge in the price of Bitcoin, marking another chapter in the digital currency's volatile and intriguing journey. As the year came to a close, the Bitcoin price reached new heights, captivating the attention of investors, enthusiasts, and skeptics alike.

Why Can't I Buy Bitcoin with Cash App?

Bitcoin Changing Wallet: A Revolution in Digital Finance

### The Rise and Impact of ارز دیجیتال Bitcoin Cash

Green Bitcoin GBTC Price Prediction: A Comprehensive Analysis

Bitcoins Keeps Dropping Price: What's Behind the Trend?

Bitcoin Price on the Rise: What Does It Mean for the Future?

links

- Bitcoin Price on December 29, 2020: A Look Back at a Historic Day

- Bitcoin Annual Price Chart: A Comprehensive Analysis

- Can I Buy Bitcoin in Brazil and Sell in US?

- Binance USDT List: A Comprehensive Guide to Trading Digital Assets on the World's Leading Exchange

- Bitcoin Mining is Not Profitable: The Reality Behind the Hype

- How to Transfer from Binance Back to Coinbase in 2019

- How Many Bitcoin Cash Are Left: The Current Status and Future Outlook

- Can I Buy Dogecoin on Binance.US?

- What's the Most Someone Has Made Selling Bitcoin Cash

- Bitcoin Cash Easy Miner: A Game-Changer for Cryptocurrency Mining