You are here:Aicha Vitalis > airdrop

Bitcoin Price Chart YTD: A Comprehensive Analysis

Aicha Vitalis2024-09-21 01:44:35【airdrop】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The Bitcoin price chart YTD, which stands for "year-to-date," has been a topic of great interest amo airdrop,dex,cex,markets,trade value chart,buy,The Bitcoin price chart YTD, which stands for "year-to-date," has been a topic of great interest amo

The Bitcoin price chart YTD, which stands for "year-to-date," has been a topic of great interest among investors and enthusiasts in the cryptocurrency market. As we delve into the current trends and historical data, it becomes evident that Bitcoin's price movements have been quite dynamic and unpredictable. In this article, we will provide a comprehensive analysis of the Bitcoin price chart YTD, exploring its key features, factors influencing its price, and potential future trends.

Firstly, let's take a look at the Bitcoin price chart YTD. As of the latest available data, the chart shows that Bitcoin has experienced significant volatility over the past year. The price has fluctuated between a low of $30,000 and a high of $65,000, showcasing the cryptocurrency's speculative nature. The chart also highlights the major price movements, such as the bull run in the first half of the year and the subsequent correction in the second half.

One of the key factors contributing to Bitcoin's price volatility is the speculative nature of the cryptocurrency market. Investors often drive the price of Bitcoin based on their expectations and beliefs, rather than fundamental analysis. This speculative behavior is evident in the Bitcoin price chart YTD, where sudden spikes and drops occur without any clear underlying cause. For instance, the bull run in the first half of the year was primarily driven by increased institutional interest and positive news regarding Bitcoin adoption.

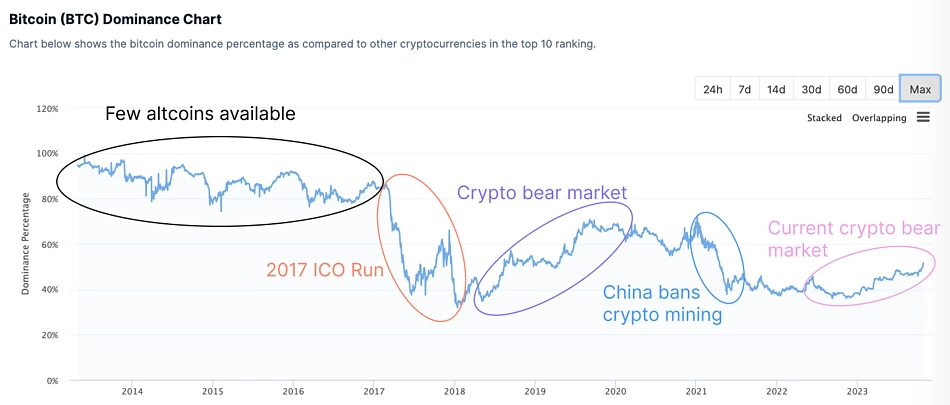

Another factor influencing the Bitcoin price chart YTD is regulatory developments. Governments and regulatory bodies around the world have been closely monitoring the cryptocurrency market, and their actions can significantly impact Bitcoin's price. For example, the introduction of regulatory frameworks in countries like China and the United States has caused uncertainty and volatility in the market. The Bitcoin price chart YTD reflects these regulatory changes, with price movements often being influenced by news and rumors related to regulatory developments.

Technological advancements also play a crucial role in shaping the Bitcoin price chart YTD. The ongoing development of the Bitcoin network, such as the implementation of the Lightning Network, aims to enhance scalability and reduce transaction fees. These technological improvements can attract new users and investors, potentially driving the price of Bitcoin higher. Conversely, any setbacks or delays in technological advancements can lead to negative sentiment and a decline in the price.

Looking ahead, the Bitcoin price chart YTD suggests that the cryptocurrency may continue to experience volatility in the near term. However, some experts believe that Bitcoin has the potential to become a mainstream asset class, similar to gold. This could lead to a more stable price trajectory in the long run. Factors such as increasing institutional adoption, the launch of Bitcoin ETFs, and the ongoing debate on the future of central bank digital currencies (CBDCs) may contribute to Bitcoin's price appreciation.

In conclusion, the Bitcoin price chart YTD has showcased a highly volatile and unpredictable market. While speculative behavior, regulatory developments, and technological advancements have played significant roles in shaping the price movements, the future of Bitcoin remains uncertain. As investors and enthusiasts continue to monitor the market, it is crucial to consider both short-term and long-term factors when analyzing the Bitcoin price chart YTD. Only time will tell whether Bitcoin will continue to be a speculative asset or evolve into a more stable and widely accepted form of digital currency.

This article address:https://www.aichavitalis.com/blog/1a22599773.html

Like!(647)

Related Posts

- How to Find New Listing on Binance: A Comprehensive Guide

- The Evolution of Localbitcoins Bitcoin Price: A Comprehensive Analysis

- The Rise and Fall of Bitcoin in Pakistan: A Look Back at the 1 Bitcoin Price in Pakistan in 2011

- Should I Move Stellar from Binance to Coinbase?

- Bitcoin Price Today GBP: A Comprehensive Analysis

- Binance Coin October 63M Venus Protocols: A Deep Dive into the Blockchain Ecosystem

- Bitcoin Mining Shipping Containers: A Game-Changing Solution for Crypto Miners

- The Correlation Between Bitcoin Price and Gold: A Comprehensive Analysis

- Best GPU for Bitcoin Mining: Unveiling the Top Performers

- Binance Neo Coin News: The Latest Developments in the Cryptocurrency Market

Popular

Recent

How to Buy Pundi X on Binance US: A Step-by-Step Guide

Best Beginner Bitcoin Wallet: Your Ultimate Guide to Securely Storing Your Cryptocurrency

Can You Change Bitcoin into Cash?

Is Mining Bitcoin Profitable in 2024?

Title: Enhancing Your Crypto Trading Strategy with the Binance Average Price Calculator

Bitcoin Digital Wallet: The Ultimate Tool for Cryptocurrency Management

Can You Buy Bitcoin with Mastercard?

Bitcoin Hacking Wallet: A Closer Look at Security Concerns and Prevention Measures

links

- Which Countries Are Mining Bitcoin: A Comprehensive Guide

- Bitcoin Cash Exchange Script: A Comprehensive Guide to Trading BCH

- What is Withdrawal Whitelist on Binance?

- Bitcoin Price in Dollars Now: A Comprehensive Analysis

- Which Countries Are Mining Bitcoin: A Comprehensive Guide

- Title: Mining Bitcoin on Mac Terminal: A Comprehensive Guide

- Rx 580 Mining Bitcoin: A Cost-Effective Solution for Aspiring Cryptocurrency Miners

- Bitcoin Mining Study: A Comprehensive Analysis of the Process and Its Impact

- How Does Mining Bitcoin Use Coal?

- How Long Does Binance US ACH Withdrawal Take?