You are here:Aicha Vitalis > markets

The Rise of Cash Out Credit Card to Bitcoin Transactions

Aicha Vitalis2024-09-20 23:40:53【markets】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the ever-evolving world of finance, the integration of traditional banking systems with the burge airdrop,dex,cex,markets,trade value chart,buy,In the ever-evolving world of finance, the integration of traditional banking systems with the burge

In the ever-evolving world of finance, the integration of traditional banking systems with the burgeoning cryptocurrency market has opened up new avenues for individuals and businesses alike. One such innovative transaction method that has gained significant traction is the cash out credit card to bitcoin process. This article delves into the mechanics, benefits, and potential risks associated with this modern financial trend.

### Understanding the Concept

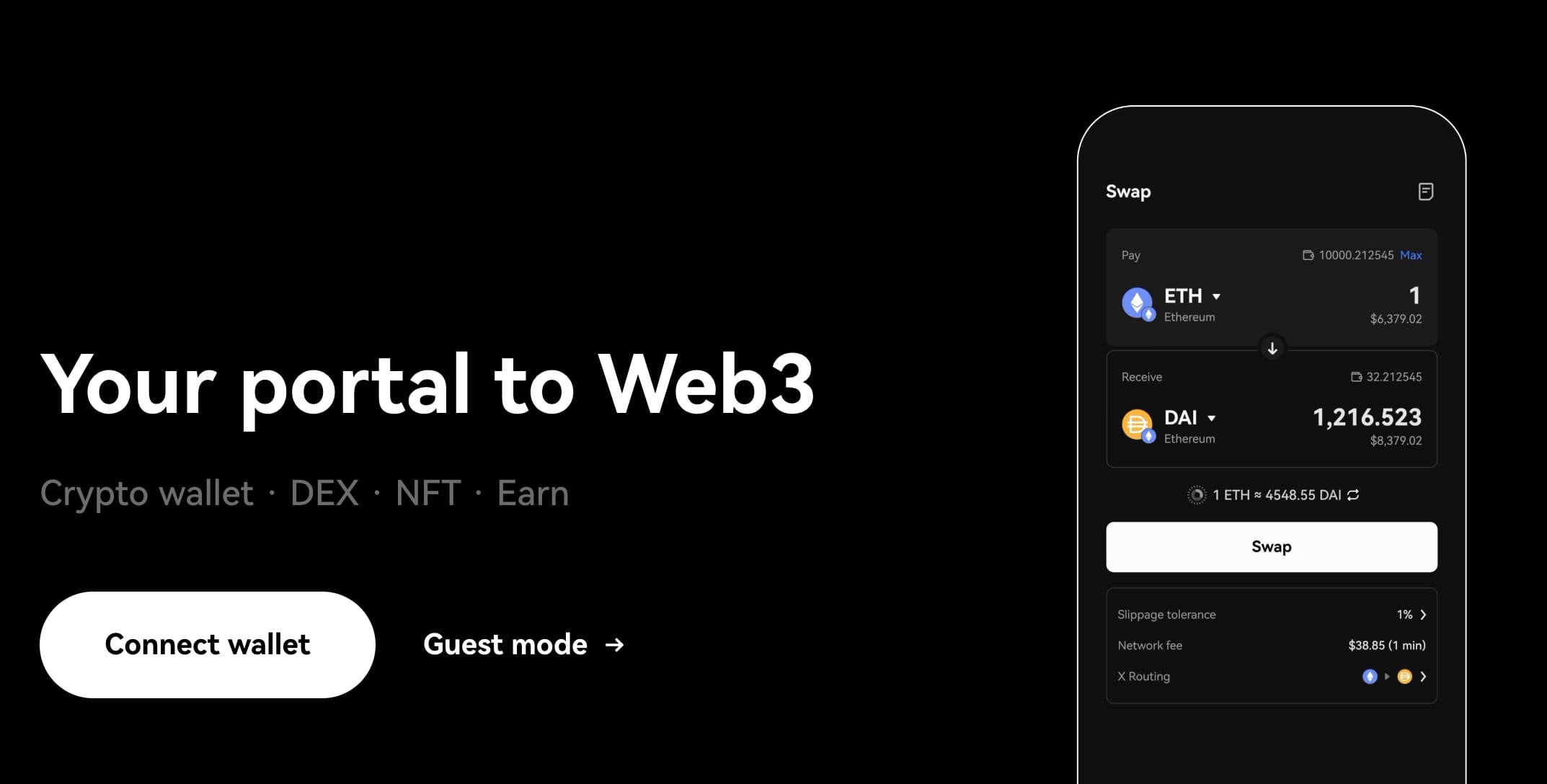

The cash out credit card to bitcoin process involves converting the available credit limit on a credit card into cryptocurrency, specifically Bitcoin. This transaction is facilitated through various online platforms and exchanges that specialize in cryptocurrency conversions. Users can then use the Bitcoin they receive to make purchases, invest, or hold as a digital asset.

### How It Works

The process of cashing out a credit card to Bitcoin typically involves the following steps:

1. **Selecting a Platform**: Users must first choose a reputable platform that offers credit card to Bitcoin conversion services.

2. **Registration**: Users need to register an account on the chosen platform, providing necessary personal and credit card information.

3. **Credit Card Authorization**: The platform will require authorization from the user's credit card provider to initiate the transaction.

4. **Conversion**: Once the credit card is authorized, the platform converts the credit card balance into Bitcoin at the current market rate.

5. **Bitcoin Deposit**: The converted Bitcoin is then deposited into the user's Bitcoin wallet, which can be accessed through the platform or a separate wallet service.

### Benefits of Cash Out Credit Card to Bitcoin

1. **Accessibility**: This method provides users with a quick and easy way to access Bitcoin, especially those who do not have direct access to cryptocurrency exchanges.

2. **Privacy**: Transactions made through credit cards to Bitcoin are often more private than traditional bank transfers, as they do not require sharing sensitive banking information.

3. **Market Opportunities**: Users can capitalize on the volatility of Bitcoin by buying low and selling high, potentially earning significant profits.

4. **Investment**: Bitcoin can be seen as a long-term investment, and this method allows users to accumulate Bitcoin without the need for a traditional brokerage account.

### Potential Risks

While the cash out credit card to Bitcoin process offers several benefits, it also comes with its own set of risks:

1. **Credit Card Fees**: Users may incur additional fees from their credit card provider for cash advances or foreign transactions.

2. **Market Volatility**: The value of Bitcoin can fluctuate wildly, leading to potential losses if the market takes a downturn.

3. **Security Concerns**: Storing Bitcoin requires a secure wallet, and there is always a risk of theft or loss of the digital currency.

4. **Legal and Regulatory Issues**: The legality of converting credit card funds to Bitcoin varies by country and can change over time, posing regulatory risks.

### Conclusion

The cash out credit card to Bitcoin process has become a popular method for individuals looking to enter the cryptocurrency market quickly and conveniently. While it offers numerous benefits, users must be aware of the associated risks and take appropriate precautions to protect their investments. As the cryptocurrency landscape continues to evolve, it is essential for users to stay informed and adapt to the changing financial environment.

This article address:https://www.aichavitalis.com/blog/25c98698988.html

Like!(433)

Related Posts

- What Bitcoin Wallet Is Compatibility: A Comprehensive Guide

- Why Can't I Withdraw BNB from Binance.US?

- Bitcoin Mining in Namibia: A Growing Industry with Promising Prospects

- **Mining Bitcoin Explained Best Video: A Comprehensive Guide to Cryptocurrency Mining

- What Countries Can You Use Binance In?

- Bitcoin Cash Run Full Node: The Ultimate Guide to Running a Full Node on the Bitcoin Cash Network

- Bitcoin Price Argentina: The Current Status and Future Outlook

- Bitcoin Wallet Stocks: A Lucrative Investment Opportunity in the Cryptocurrency Market

- How to Buy Solana on Binance: A Step-by-Step Guide

- Can I Use Binance in Hong Kong?

Popular

Recent

Binance Neue Coins: The Future of Cryptocurrency Trading

Can Anyone Use Bitcoin?

Can You Convert Bitcoins into Real Money?

Bitcoin Price Hourly: The Dynamic World of Cryptocurrency Trading

Bitcoin Cash Spot Price: A Comprehensive Analysis

What Happens If Bitcoin Mining Stops?

Where Can I Use My Bitcoin Cash?

How to Convert BTC on Binance: A Step-by-Step Guide

links

- Bitcoin You Can Transfer Instantly: Revolutionizing the Financial World

- Binance OMG BTC: The Ultimate Guide to Understanding the Cryptocurrency Pair

- What is Driving the Price of Bitcoin?

- How to Cash Out Bitcoin Miner Game: A Comprehensive Guide

- Bitcoin You Can Transfer Instantly: Revolutionizing the Financial World

- The Biggest Bitcoin Mining Farm in the World

- What Port Does Bitcoin Wallet Use: A Comprehensive Guide

- Bitcoin Mining with 2080 Ti: A Comprehensive Guide

- Binance or Binance.US App: A Comprehensive Guide to the Leading Cryptocurrency Exchange

- Unlocking the Potential of Free Bitcoin Mining Sites: A Comprehensive Guide