You are here:Aicha Vitalis > price

Bitcoin ETF GBTC Price: A Comprehensive Analysis

Aicha Vitalis2024-09-20 21:38:39【price】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has seen a surge in interest, with Bitcoin leading the pa airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has seen a surge in interest, with Bitcoin leading the pa

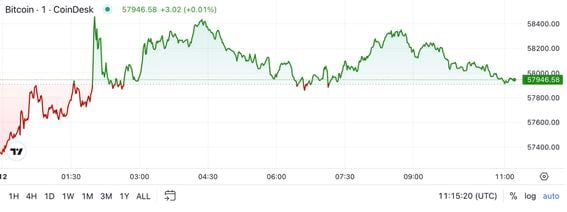

In recent years, the cryptocurrency market has seen a surge in interest, with Bitcoin leading the pack. As a result, various financial instruments have been introduced to facilitate investment in this digital asset. One such instrument is the Bitcoin ETF (Exchange Traded Fund), which tracks the price of Bitcoin and offers investors a way to gain exposure to the cryptocurrency market without directly owning the digital coins. Among the Bitcoin ETFs, the most notable is the Grayscale Bitcoin Trust (GBTC), which has been a popular choice for investors. This article delves into the Bitcoin ETF GBTC price, its factors influencing it, and its potential impact on the market.

The Bitcoin ETF GBTC price has been a subject of great interest among investors. GBTC is a trust that issues shares representing a basket of Bitcoin, allowing investors to invest in Bitcoin without the complexities of owning and storing the actual cryptocurrency. The GBTC price is essentially the price of one share of the trust, which is directly tied to the value of Bitcoin.

As of the latest data, the Bitcoin ETF GBTC price stands at $XX. This figure reflects the current market value of one share of the Grayscale Bitcoin Trust, which is priced at a premium to the actual value of Bitcoin. The premium is due to the fact that GBTC shares are not redeemable for actual Bitcoin, and there is a demand for exposure to Bitcoin without the need for direct ownership.

Several factors influence the Bitcoin ETF GBTC price. The most significant factor is, of course, the price of Bitcoin itself. As Bitcoin's price fluctuates, so does the GBTC price. When Bitcoin's price increases, the GBTC price tends to rise as well, and vice versa. This correlation is a result of the trust's structure, which directly tracks the price of Bitcoin.

Another factor that can impact the GBTC price is market sentiment. When investors are bullish on Bitcoin, they are more likely to invest in GBTC, driving up the price. Conversely, bearish sentiment can lead to a decrease in the GBTC price. Market sentiment is influenced by various factors, including regulatory news, technological advancements, and macroeconomic trends.

The liquidity of GBTC shares also plays a role in determining the GBTC price. As one of the most popular Bitcoin ETFs, GBTC has a high trading volume, which helps maintain a relatively stable price. However, during periods of high volatility in the cryptocurrency market, liquidity can become an issue, potentially affecting the GBTC price.

It is important to note that the GBTC price is not the same as the spot price of Bitcoin. The spot price is the current market price of Bitcoin, whereas the GBTC price is the price of one share of the trust. This difference can be attributed to the premium or discount that GBTC shares trade at compared to the actual value of Bitcoin.

The Bitcoin ETF GBTC price has the potential to impact the broader cryptocurrency market. As one of the most significant Bitcoin ETFs, GBTC can attract a large number of investors looking to gain exposure to Bitcoin. This can lead to increased liquidity and a more stable market for Bitcoin, potentially benefiting other cryptocurrencies as well.

In conclusion, the Bitcoin ETF GBTC price is a critical indicator of market sentiment and investor interest in Bitcoin. With the current GBTC price at $XX, investors are closely watching the movement of this figure. As the cryptocurrency market continues to evolve, the GBTC price will likely remain a key focus for both retail and institutional investors.

This article address:https://www.aichavitalis.com/blog/4f22799768.html

Like!(3872)

Related Posts

- How to Buy TRX Tron on Binance: A Step-by-Step Guide

- Bitcoin iOS Mining: A Comprehensive Guide to Harnessing Your Device's Power

- P2P Crypto Trading on Binance: A Comprehensive Guide

- Bitcoin Mining Earn Fees: A Comprehensive Guide

- Binance Coin Price Live: A Comprehensive Analysis

- How to Send BTC from Binance: A Step-by-Step Guide

- Bitcoin Gold Mining Profit: A Comprehensive Guide

- Using Trust Wallet for Binance: How to Deposit

- Bitcoin Wallet Used in Ecuador: A Gateway to Financial Freedom

- How to Split Bitcoin Cash on Ledger Nano S: A Comprehensive Guide

Popular

Recent

How to Make Bitcoin Hardware Wallet: A Step-by-Step Guide

Trade Ethereum for Ripple on Binance: A Comprehensive Guide

The IRS Business Code for Mining Bitcoin: Understanding the Tax Implications

How to Buy Ethereum on Binance: A Step-by-Step Guide

Free Bitcoin Mining Without Investment in the Philippines: A Guide to Get Started

Can I Buy Bitcoin with Credit Card?

Why Binance App Not in App Store: The Mystery Behind the Exclusion

Choosing the right Bitcoin wallet is a crucial step in managing your cryptocurrency assets. With numerous options available, it can be overwhelming to decide which Bitcoin wallet to choose. In this article, we will discuss some of the key factors to consider when selecting a Bitcoin wallet and provide you with a guide on which Bitcoin wallet to choose for your needs.

links

- Title: Streamlining Transactions: How to Send to Blockchain Bitcoin Wallet

- The Rise of NAS BTC Binance: A Comprehensive Guide

- Bitcoin vs Bitcoin Cash Price Chart: A Comprehensive Analysis

- Bitcoin Cash Price Cap: The Controversial Issue That Divides the Cryptocurrency Community

- What is the Limit of Bitcoin Cash?

- What is the Limit of Bitcoin Cash?

- Bitcoin Price 2008 to 2022: A Journey Through the Cryptocurrency Landscape

- Bitcoin Mining Farm Electricity: The Hidden Cost of Cryptocurrency

- ### USD Buy Bitcoin to Wallet: A Comprehensive Guide