You are here:Aicha Vitalis > block

Bitcoin Price Sterling: A Comprehensive Analysis

Aicha Vitalis2024-09-21 02:49:58【block】7people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has experienced a significant surge in popularity, with B airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has experienced a significant surge in popularity, with B

In recent years, the cryptocurrency market has experienced a significant surge in popularity, with Bitcoin being the most prominent digital currency. The value of Bitcoin has fluctuated dramatically since its inception in 2009, and one of the most sought-after metrics is the Bitcoin price in Sterling (GBP). This article aims to provide a comprehensive analysis of the Bitcoin price in Sterling, exploring its factors, trends, and future prospects.

The Bitcoin price in Sterling is influenced by various factors, including global economic conditions, regulatory news, technological advancements, and market sentiment. One of the primary factors affecting the Bitcoin price in Sterling is the global economic landscape. For instance, during times of economic uncertainty, investors often seek refuge in Bitcoin, leading to an increase in its value. Conversely, when the economy is stable, Bitcoin's price may experience downward pressure.

Another crucial factor is regulatory news. Governments around the world have varying stances on cryptocurrencies, and any regulatory changes can significantly impact the Bitcoin price in Sterling. For example, if a major country were to ban cryptocurrencies, it could lead to a sharp decline in the Bitcoin price in Sterling.

Technological advancements also play a vital role in determining the Bitcoin price in Sterling. Innovations in blockchain technology, such as the development of new cryptocurrencies or improvements in Bitcoin's scalability, can influence investor confidence and, subsequently, the price of Bitcoin.

Market sentiment is another critical factor affecting the Bitcoin price in Sterling. This sentiment is driven by news, rumors, and speculation, which can cause rapid price fluctuations. For instance, if a well-known investor were to publicly express skepticism about Bitcoin, it could lead to a sell-off and a decrease in the Bitcoin price in Sterling.

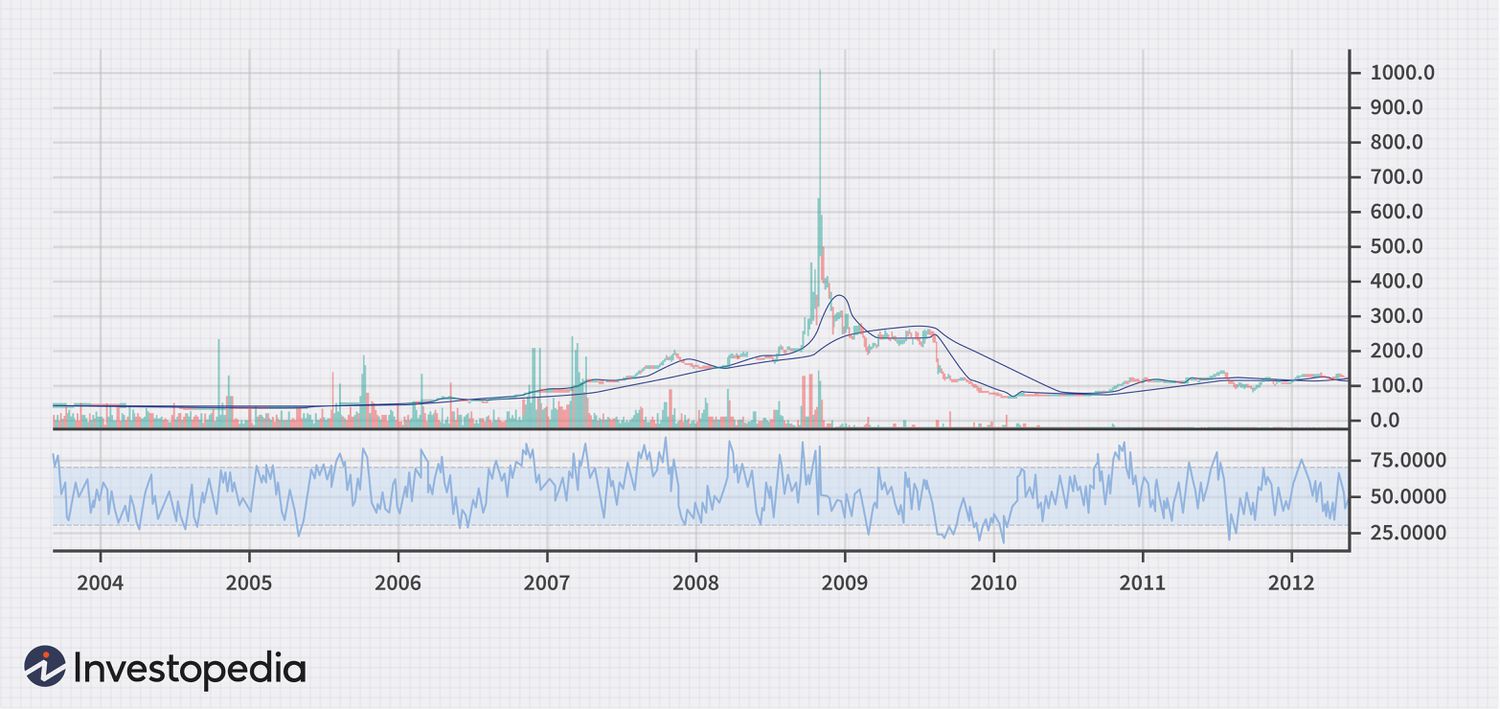

In recent years, the Bitcoin price in Sterling has experienced both significant gains and losses. In 2017, Bitcoin reached an all-time high of nearly £18,000, only to plummet to around £3,000 by the end of 2018. Since then, the cryptocurrency has seen a steady recovery, with the Bitcoin price in Sterling currently hovering around £8,000.

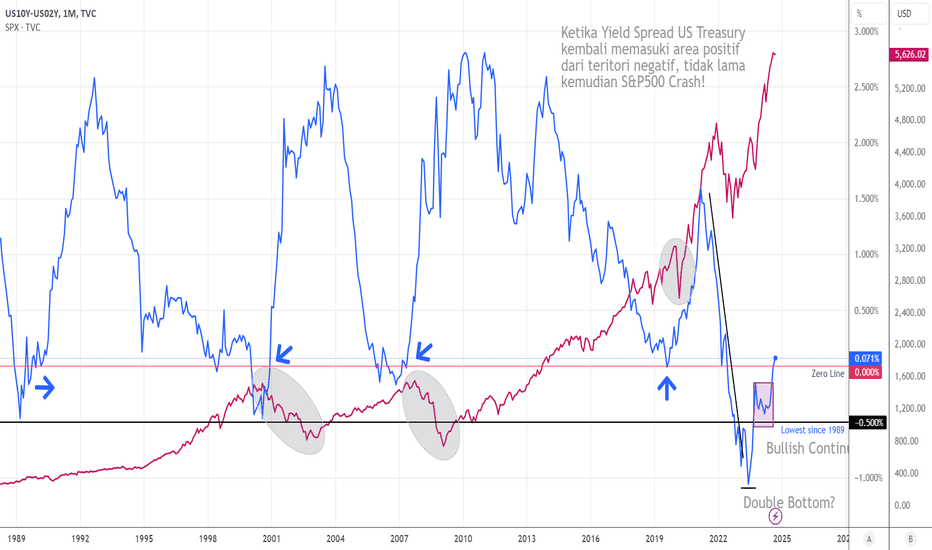

Looking at the historical data, we can observe several trends in the Bitcoin price in Sterling. One notable trend is the correlation between Bitcoin's price and the stock market. During periods of market turmoil, Bitcoin tends to perform well, as investors seek alternative investment options. Additionally, the Bitcoin price in Sterling has shown a strong correlation with the USD, as the cryptocurrency is often priced in dollars.

In terms of future prospects, several factors could influence the Bitcoin price in Sterling. One potential driver is the increasing adoption of cryptocurrencies by both retail and institutional investors. As more people recognize the potential of Bitcoin as a store of value and a hedge against inflation, the demand for the cryptocurrency is likely to rise, pushing the price higher.

Moreover, the growing interest in decentralized finance (DeFi) could also contribute to the rise in the Bitcoin price in Sterling. DeFi platforms are built on blockchain technology and offer various financial services without the need for traditional intermediaries. As DeFi gains traction, it could drive more institutional investors to explore cryptocurrencies, including Bitcoin.

However, there are also risks that could impact the Bitcoin price in Sterling. One significant risk is regulatory intervention, as governments may impose stricter regulations on cryptocurrencies to mitigate potential financial risks. Additionally, technological vulnerabilities or security breaches could erode investor confidence and lead to a decline in the Bitcoin price.

In conclusion, the Bitcoin price in Sterling is influenced by a variety of factors, including global economic conditions, regulatory news, technological advancements, and market sentiment. While the cryptocurrency has experienced significant volatility in the past, its potential as a store of value and a hedge against inflation continues to attract investors. As the market evolves, it is crucial to monitor these factors closely to understand the future trends in the Bitcoin price in Sterling.

This article address:https://www.aichavitalis.com/blog/60e07599864.html

Like!(6)

Related Posts

- The 1 Share Price of Bitcoin: A Comprehensive Analysis

- The Intricacies of Bitcoin Price Difference on Coinbase: Understanding the Variations

- How to Convert Bitcoin into Steam Cash: A Step-by-Step Guide

- Who Accepts Bitcoin Cash: A Comprehensive Guide

- Binance New Coin Listing 2022: A Comprehensive Guide

- Genesis Mining Stock Rate for Bitcoin: A Comprehensive Analysis

- Current Prices of Bitcoin and Ethereum: A Comprehensive Analysis

- Peat Moss Energy for Bitcoin Mining: A Sustainable Solution

- Title: QR Code Bitcoin Wallet BRD: A User-Friendly Solution for Cryptocurrency Transactions

- O que é USDT Binance: Understanding the World's Leading Stablecoin on Binance

Popular

Recent

Can I Lose My Bitcoins?

Why Do You Get Paid for Bitcoin Mining?

**Sports Betting with Bitcoin Cash: A New Era of Transparency and Speed

Current Prices of Bitcoin and Ethereum: A Comprehensive Analysis

Bitclub Bitcoin Cloud Mining: A Comprehensive Guide to the World of Cryptocurrency Investment

How to Transfer Bitcoin from Coinmama to Another Wallet

Unlocking the Convenience of Bovada Bitcoin Withdrawal with Cash App

How to Transfer Bitcoin from CEX.IO to Your Wallet: A Step-by-Step Guide

links

- Which Bitcoin Wallet is Best: A Comprehensive Guide

- Open Source Python Bitcoin Mining GPU: A Comprehensive Guide

- Get Wallet Bitcoin: A Comprehensive Guide to Managing Your Cryptocurrency

- Binance BNB Was Chosen: The Ultimate Choice for Cryptocurrency Users

- Bitcoin Cash No Fees: A Game-Changing Solution for Digital Transactions

- Bitcoin Cash Expectation: A Glimpse into the Future of Cryptocurrency

- Open Source Python Bitcoin Mining GPU: A Comprehensive Guide

- Bitcoin Cash Expectation: A Glimpse into the Future of Cryptocurrency

- How to Buy BEP20 on Binance: A Step-by-Step Guide

- Will Pi Be Listed on Binance? A Comprehensive Analysis