You are here:Aicha Vitalis > block

Bitcoin Price Future Analysis: A Comprehensive Outlook

Aicha Vitalis2024-09-21 22:41:14【block】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense debate and spec airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense debate and spec

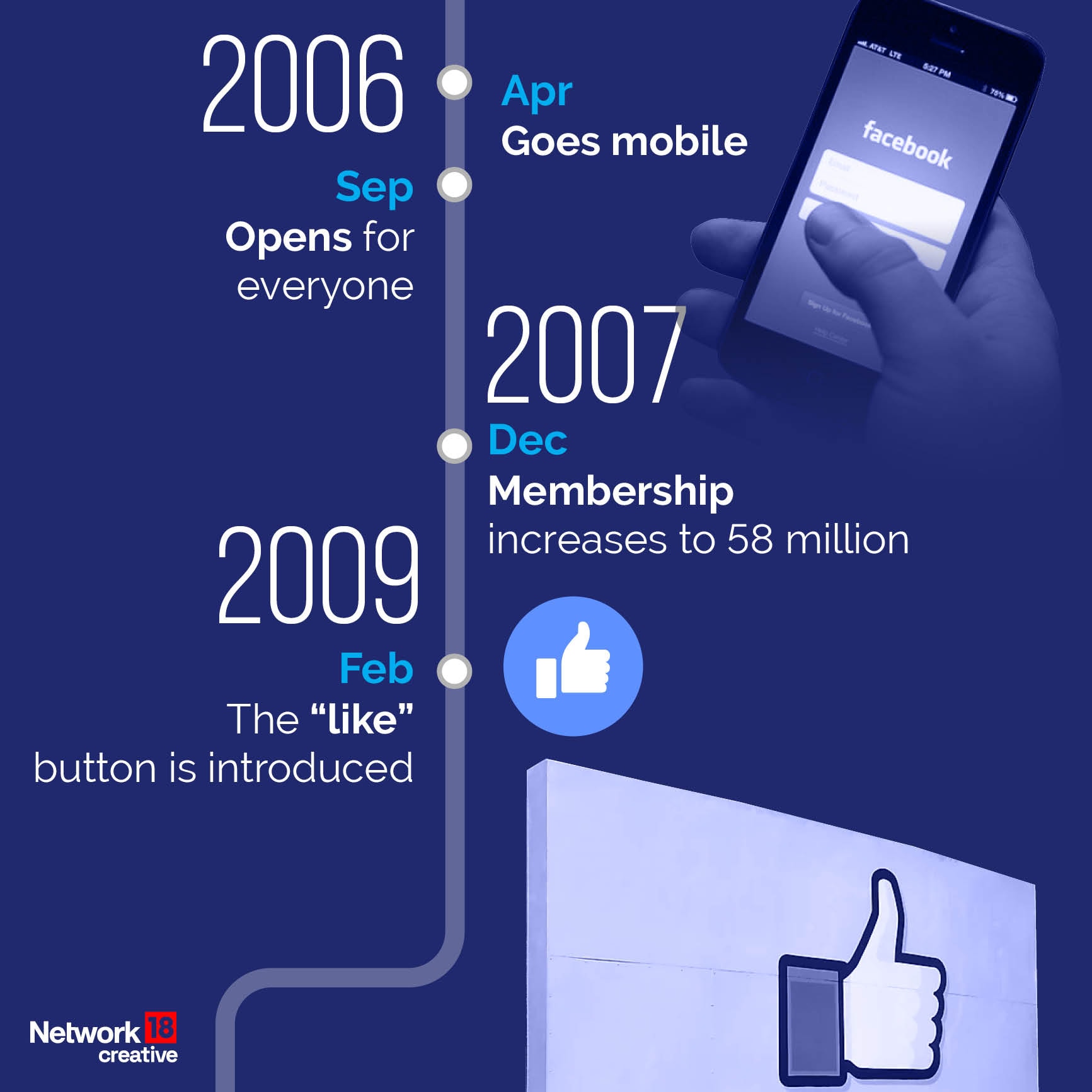

Bitcoin, the world's first decentralized cryptocurrency, has been a topic of intense debate and speculation since its inception in 2009. As the digital currency continues to gain traction, investors and enthusiasts are eager to predict its future price trajectory. This article aims to provide a comprehensive outlook on the Bitcoin price future analysis, considering various factors that could influence its value.

Bitcoin Price Future Analysis: Factors to Consider

1. Market Supply and Demand

One of the primary factors influencing Bitcoin's price is the supply and demand dynamics in the market. As Bitcoin is a finite asset, with a maximum supply of 21 million coins, scarcity can drive up its value. Additionally, the increasing adoption of Bitcoin as a medium of exchange and investment can boost demand, potentially leading to higher prices.

Bitcoin Price Future Analysis: Market Supply and Demand

2. Regulatory Environment

The regulatory landscape plays a crucial role in shaping Bitcoin's future. Governments around the world are still grappling with how to regulate cryptocurrencies, and any favorable regulatory news can boost investor confidence and drive up prices. Conversely, stringent regulations or outright bans can lead to a decline in Bitcoin's value.

Bitcoin Price Future Analysis: Regulatory Environment

3. Technological Developments

Technological advancements, such as improvements in blockchain technology and the development of new applications, can significantly impact Bitcoin's price. Innovations like the Lightning Network can enhance Bitcoin's scalability and make it more practical for everyday transactions, potentially increasing its value.

Bitcoin Price Future Analysis: Technological Developments

4. Economic Factors

Economic factors, such as inflation, currency devaluation, and geopolitical tensions, can also influence Bitcoin's price. As a hedge against traditional financial systems, Bitcoin may attract investors looking for alternative assets during times of economic uncertainty.

Bitcoin Price Future Analysis: Economic Factors

5. Market Sentiment

Market sentiment can be a powerful driver of Bitcoin's price. Positive news, such as high-profile endorsements or successful use cases, can lead to a bull market, while negative news, such as security breaches or regulatory crackdowns, can trigger a bear market.

Bitcoin Price Future Analysis: Market Sentiment

Conclusion

In conclusion, Bitcoin's price future analysis is a complex and multifaceted endeavor. Various factors, including market supply and demand, regulatory environment, technological developments, economic factors, and market sentiment, can influence its value. While it is challenging to predict the exact trajectory of Bitcoin's price, understanding these factors can help investors make informed decisions. As the cryptocurrency landscape continues to evolve, staying informed and adaptable will be key to navigating the Bitcoin price future analysis.

This article address:https://www.aichavitalis.com/blog/67b22199711.html

Like!(59)

Related Posts

- Can You Buy Bitcoin Without ID?

- How to Check If Your PC Is Mining Bitcoin

- Bitcoin Price Today: A Comprehensive Analysis Using TradingView

- Can You Buy Bitcoin in the USA?

- ### The Thriving World of Mining Bitcoin or Ethereum: A Comprehensive Guide

- Best Bitcoin Hardware Wallet Amazon: The Ultimate Guide to Secure Your Cryptocurrency

- Bitcoin Web Wallet: The Ultimate Guide to Securely Managing Your Cryptocurrency

- How to Buy Fun Token on Binance: A Step-by-Step Guide

- Bitcoin Expected Price in 2019: A Comprehensive Analysis

- Title: Diff Between Bitcoin and Bitcoin Cash: Understanding the Key Differences

Popular

Recent

015 Bitcoin to Cash: The Intersection of Digital Currency and Traditional Transactions

Bitcoin Cash Lite Wallet That Can Generate Addresses: A Comprehensive Guide

How Much Money Does Mining Bitcoin Make?

Is Bitcoin Convertible to Cash?

Free Bitcoin Cash App Como Funciona: A Comprehensive Guide

How to Buy Fun Token on Binance: A Step-by-Step Guide

Can You Buy a Tesla with Bitcoin in 2022?

Is My Bitcoin Wallet Traceable?

links

- FOMO Coin Binance: The Future of Cryptocurrency Trading

- Bitcoin E-Wallet Card: A Game-Changer for Cryptocurrency Users

- Best Bitcoin ATMs in Canada: Your Ultimate Guide to Secure and Convenient Transactions

- How to Convert Crypto to Cash in Binance: A Step-by-Step Guide

- Where Can I Trade Binance Coin: A Comprehensive Guide

- How to Convert Your Bitcoin into Cash

- Bitcoin Diamond Futures Mining: A New Era in Cryptocurrency Investment

- Bitcoin Price USS: The Current Status and Future Outlook

- Bitcoin E-Wallet Card: A Game-Changer for Cryptocurrency Users

- www Bitcoin Mining Software: The Ultimate Guide to Choosing the Best Solution