You are here:Aicha Vitalis > chart

Bitcoin vs Bitcoin Cash Transaction Fees: A Comprehensive Analysis

Aicha Vitalis2024-09-20 21:23:31【chart】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrencies, Bitcoin and Bitcoin Cash are two of the most prominent and widely airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrencies, Bitcoin and Bitcoin Cash are two of the most prominent and widely

In the world of cryptocurrencies, Bitcoin and Bitcoin Cash are two of the most prominent and widely recognized digital currencies. Both of these currencies have their own unique features and advantages, but one aspect that often sparks debate is their transaction fees. In this article, we will delve into the differences between Bitcoin and Bitcoin Cash transaction fees, providing a comprehensive analysis to help you understand the nuances of each.

Bitcoin vs Bitcoin Cash Transaction Fees: Understanding the Basics

To begin with, let's clarify the basic concept of transaction fees. Transaction fees are the charges imposed on users for processing their transactions on a blockchain network. These fees are essential for maintaining the network's security and incentivizing miners to validate and add new blocks to the blockchain.

Bitcoin vs Bitcoin Cash Transaction Fees: Bitcoin's Approach

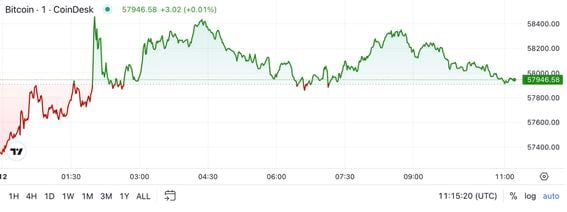

Bitcoin, the first and most well-known cryptocurrency, has been around since 2009. Over the years, Bitcoin has faced scalability issues, particularly in terms of transaction fees. Initially, Bitcoin transaction fees were relatively low, but as the network grew, the demand for transactions increased, leading to higher fees.

Bitcoin's transaction fees are influenced by several factors, including the size of the transaction, the network congestion, and the competition among miners. During peak times, such as during the 2017 bull run, Bitcoin transaction fees soared to over $50 per transaction. However, as the network evolved, Bitcoin introduced several improvements, such as SegWit (Segregated Witness), which helped reduce transaction fees.

Bitcoin vs Bitcoin Cash Transaction Fees: Bitcoin Cash's Approach

Bitcoin Cash, on the other hand, was created as a hard fork of Bitcoin in 2017. Its primary goal was to address Bitcoin's scalability issues by increasing the block size limit from 1 MB to 8 MB. This change allowed Bitcoin Cash to process more transactions per block, thereby reducing transaction fees.

Bitcoin Cash transaction fees are generally lower than Bitcoin's, especially during peak times. This is because the increased block size allows Bitcoin Cash to handle a higher volume of transactions, leading to a more competitive market for miners. Moreover, Bitcoin Cash has implemented several other improvements, such as the Lightning Network, which further enhances its scalability and reduces transaction fees.

Bitcoin vs Bitcoin Cash Transaction Fees: The Bottom Line

In conclusion, Bitcoin vs Bitcoin Cash transaction fees present a clear contrast between the two cryptocurrencies. While Bitcoin has faced scalability issues and high transaction fees in the past, Bitcoin Cash has successfully addressed these concerns by increasing the block size and implementing various improvements.

However, it's important to note that transaction fees are just one aspect of a cryptocurrency's ecosystem. Other factors, such as network security, decentralization, and adoption, also play a crucial role in determining a cryptocurrency's success. As the crypto market continues to evolve, it will be interesting to see how Bitcoin and Bitcoin Cash adapt to new challenges and opportunities.

In the end, whether you prefer Bitcoin or Bitcoin Cash, understanding the differences in transaction fees can help you make informed decisions about your investments and usage of these digital currencies. As always, it's essential to stay updated with the latest developments in the crypto world to make the most of your investments.

This article address:https://www.aichavitalis.com/blog/71c15499774.html

Like!(1428)

Related Posts

- Binance Buy Dip: A Strategic Approach to Cryptocurrency Investment

- Can Bitcoin Be Converted to PerfectMoney?

- Bitcoin Coin Containing Paper Wallet: A Secure and Convenient Storage Solution

- Can You Recover Old Bitcoin Wallet: A Comprehensive Guide

- Binance-Trade: The Ultimate Platform for Cryptocurrency Trading

- How to Send Bitcoin from PayPal to Trust Wallet

- ### Set Up Bitcoin Wallet Reddit: A Comprehensive Guide

- The USDT Interest Rate on Binance: A Closer Look at the Digital Currency's Yield Potential

- Binance USDT List: A Comprehensive Guide to Trading Digital Assets on the World's Leading Exchange

- Mining Bitcoin in Canada: A Lucrative and Growing Industry

Popular

Recent

Free Bitcoin Mining Without Investment in the Philippines: A Guide to Get Started

Bitcoin Mining in Zambia: A Growing Industry with Promising Prospects

Title: Streamline Your Bitcoin Cash Management with the Claim Bitcoin Cash Manager App

The Emergence of New Bitcoin Address on Binance: A Game-Changer for Cryptocurrency Users

How Do I Find My List Bitcoin Wallet Address Lookup: A Comprehensive Guide

How to Buy Bitcoin Cash in Mexico: A Comprehensive Guide

Mining Bitcoin with Raspberry Pi 4: A Cost-Effective Approach

Reddit Bitcoin Wallet Explained: A Comprehensive Guide

links

- The Rise of US Bitcoin Mining Hardware: A Game-Changer in Cryptocurrency Mining

- Title: Enhancing Your Bitcoin Mining Success with the Bitcoin Mining Probability Calculator

- How to Force Bitcoin Out of a Wallet: A Comprehensive Guide

- Can I Get Special Bitcoins on the Regular Wallet?

- Cash App Bitcoin Scams: Protecting Yourself from Cyber Fraud

- Best Bitcoin Wallet Apps for Android: Secure Your Crypto Assets on the Go

- Ledger Wallet's Definition of Bitcoin: A Comprehensive Overview

- Title: Exploring the World of Test Bitcoin Wallets

- How to Invest in Bitcoin Price: A Comprehensive Guide

- How Do I Buy BTT on Binance: A Step-by-Step Guide