You are here:Aicha Vitalis > price

The Rising Costs of Mining Bitcoin: A Comprehensive Analysis

Aicha Vitalis2024-09-20 23:25:29【price】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of the digital economy airdrop,dex,cex,markets,trade value chart,buy,In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of the digital economy

In the ever-evolving world of cryptocurrencies, Bitcoin remains a cornerstone of the digital economy. As more individuals and entities seek to participate in the Bitcoin mining process, the cost associated with it has become a significant concern. This article delves into the various factors contributing to the mining cost of Bitcoin, providing a comprehensive analysis of this crucial aspect of the cryptocurrency ecosystem.

**The Basics of Bitcoin Mining

**Before we delve into the costs, it's essential to understand what Bitcoin mining entails. Bitcoin mining is the process by which new bitcoins are entered into circulation and is also a critical component of the maintenance and development of the blockchain ledger. Miners use powerful computers to solve complex mathematical problems, and when they do, they are rewarded with newly minted bitcoins and transaction fees.

**Electricity Costs: The Largest Component of Mining Cost

**The most significant factor contributing to the mining cost of Bitcoin is electricity. Since mining requires a substantial amount of computational power, miners must pay for the electricity to run their hardware. The cost of electricity varies widely depending on the region, with some countries offering cheaper rates than others. For instance, countries like Iceland, with its abundant geothermal energy, have become popular destinations for Bitcoin mining operations due to their low electricity costs.

**Hardware Costs

**The next major cost is the hardware itself. Miners need specialized equipment known as ASICs (Application-Specific Integrated Circuits) to perform the necessary computations. The cost of these ASICs can range from a few thousand dollars to tens of thousands, depending on the model and its efficiency. As the difficulty of mining increases, miners often need to invest in more powerful and expensive hardware to stay competitive.

**Maintenance and Cooling Costs

**Mining equipment generates a significant amount of heat, which requires effective cooling systems to prevent overheating and damage to the hardware. This not only adds to the initial cost but also to the ongoing maintenance expenses. The cost of cooling can be substantial, especially in regions with high temperatures or where the equipment is housed in energy-intensive data centers.

**Mining Pools and Transaction Fees

**Joining a mining pool can also incur costs. Mining pools are groups of miners who combine their resources to increase their chances of solving a block and earning a reward. While joining a pool can be more profitable than solo mining, it often requires a subscription fee or a share of the profits. Additionally, transaction fees paid for each block solved also contribute to the overall cost.

**Market Fluctuations and Difficulty Adjustments

**The value of Bitcoin and the difficulty of mining are closely linked. As the price of Bitcoin rises, more miners enter the market, increasing the difficulty of mining and, consequently, the cost. Conversely, when the price falls, some miners may exit, reducing the difficulty and potentially lowering the cost for those who remain.

**Conclusion

**The mining cost of Bitcoin is a multifaceted issue that encompasses electricity, hardware, maintenance, and market dynamics. As the cryptocurrency continues to grow in popularity, these costs are likely to remain a critical factor for miners. Understanding and managing these costs is essential for miners to remain profitable in what is often a highly competitive and volatile industry. Whether through strategic location choices, efficient hardware, or participation in mining pools, miners must continually adapt to the changing landscape of Bitcoin mining to ensure long-term viability.

This article address:https://www.aichavitalis.com/blog/9a16299828.html

Like!(9)

Related Posts

- Clsk Mining Bitcoin: A Comprehensive Guide to the World of Cryptocurrency Mining

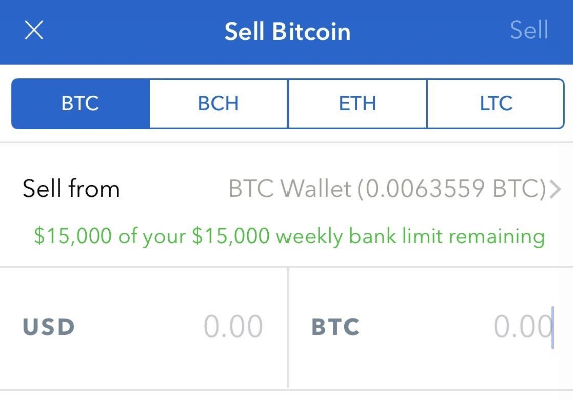

- Bitcoin Verkopen Voor Cash: A Guide to Selling Your Cryptocurrency for Physical Currency

- Bitcoin ATM Prices Near Me: A Comprehensive Guide

- How to Copy Trade on Binance: A Comprehensive Guide

- Binance to Ronin Wallet: A Seamless Transition for Crypto Users

- Bitcoin Price Summer 2014: A Look Back at the Cryptocurrency's Rapid Rise

- Buy Cloud Mining with Bitcoin: A Lucrative Investment Opportunity

- Can Bitcoin Be Purchased with Cash?

- Bitcoin Encrypt Wallet vs Encrypt Address: A Comprehensive Comparison

- The Rise of Cryptocurrency: Understanding the Importance of a Price Converter Bitcoin

Popular

Recent

The Initial Price of Bitcoin: A Journey Through Time

Bitcoin Wallets That Link to Bank Accounts: The Ultimate Guide to Secure and Convenient Transactions

**Understanding the Role of Wallet.dat in Bitcoin Core

Bitcoin 20000 Price: A Milestone in Cryptocurrency's Journey

Binance Smart Chain Safemoon: A Comprehensive Guide to the Future of Cryptocurrency

How to Copy Trade on Binance: A Comprehensive Guide

Bitcoin Mining Hardware Manufacturers: The Backbone of Cryptocurrency Mining

Bitcoin Mining Speed Test: Unveiling the Efficiency of Your Rig

links

- Can I Buy Bitcoin Cash on Coinbase?

- Bitcoin Core Getting Bitcoin Cash: A Comprehensive Guide

- Binance, one of the leading cryptocurrency exchanges in the world, has recently announced the listing of Dym (DYM) on its platform. This marks a significant milestone for the Dym community and enthusiasts alike, as it opens up a new avenue for trading and investment opportunities.

- Can I Buy Telcoin on Binance?

- Is Bitcoin Mining a Lucrative Venture?

- How Do I Do Bitcoin on Cash App?

- Can I Buy Bitcoin Cash on Coinbase?

- Binance Smart Chain Ecosystem List: A Comprehensive Overview

- Is Bitcoin Safe on Cash App?

- How to Buy Other Currencies on Binance: A Step-by-Step Guide