You are here:Aicha Vitalis > news

The Blackrock Bitcoin ETF Share Price: A Comprehensive Analysis

Aicha Vitalis2024-09-20 23:37:19【news】2people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has seen a surge in interest from investors worldwide. On airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has seen a surge in interest from investors worldwide. On

In recent years, the cryptocurrency market has seen a surge in interest from investors worldwide. One of the most notable developments in this sector is the launch of the Blackrock Bitcoin ETF (Exchange Traded Fund). This innovative financial product has captured the attention of many, and its share price has been a topic of much discussion. In this article, we will delve into the Blackrock Bitcoin ETF share price, its implications, and the factors that may influence its future performance.

The Blackrock Bitcoin ETF, which was launched in October 2021, is a significant milestone in the cryptocurrency industry. As one of the world's largest asset management firms, Blackrock's entry into the Bitcoin market has been eagerly anticipated. The ETF is designed to track the price of Bitcoin and provide investors with exposure to the cryptocurrency market without the need to directly purchase Bitcoin.

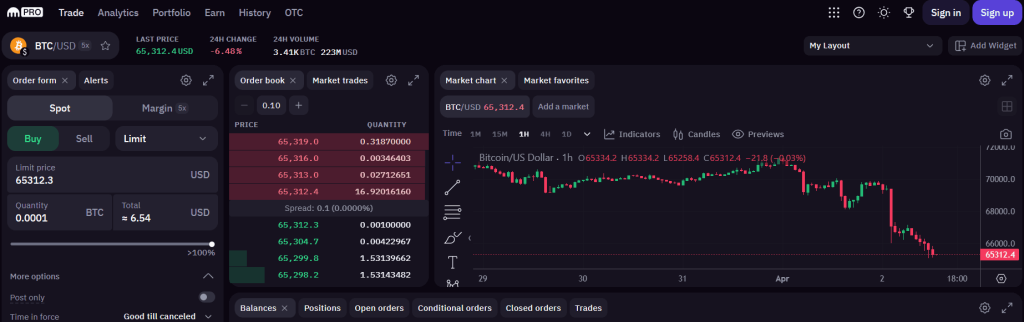

The Blackrock Bitcoin ETF share price has experienced significant volatility since its launch. Initially, the share price was around $50, but it quickly surged to over $100 within a few months. This surge can be attributed to the growing interest in Bitcoin and the increasing acceptance of cryptocurrencies as a legitimate investment asset. The Blackrock Bitcoin ETF share price has since stabilized, but it remains a highly sought-after investment vehicle.

One of the key factors that have influenced the Blackrock Bitcoin ETF share price is the regulatory environment. Governments around the world have been grappling with how to regulate cryptocurrencies, and this uncertainty has had a significant impact on the market. In some countries, such as the United States, regulatory authorities have been cautious in their approach, which has led to volatility in the share price. However, as regulations become clearer, the Blackrock Bitcoin ETF share price may stabilize and become more attractive to investors.

Another factor that has influenced the Blackrock Bitcoin ETF share price is market sentiment. As with any investment, the share price is heavily influenced by investor confidence and sentiment. During periods of optimism, the share price tends to rise, while during periods of pessimism, it tends to fall. The Blackrock Bitcoin ETF share price has been no exception, with significant fluctuations in response to market sentiment.

The Blackrock Bitcoin ETF share price has also been affected by the broader cryptocurrency market. As the largest cryptocurrency by market capitalization, Bitcoin has a significant influence on the entire market. When Bitcoin's price rises, the Blackrock Bitcoin ETF share price tends to follow suit, and vice versa. This correlation highlights the importance of Bitcoin in the cryptocurrency market and its impact on the Blackrock Bitcoin ETF share price.

In conclusion, the Blackrock Bitcoin ETF share price has been a subject of much interest since its launch. Its share price has experienced significant volatility, influenced by regulatory developments, market sentiment, and the broader cryptocurrency market. As the world continues to grapple with the implications of cryptocurrencies, the Blackrock Bitcoin ETF share price will likely remain a key indicator of investor sentiment and the overall health of the cryptocurrency market. Whether you are an experienced investor or a beginner looking to enter the market, keeping an eye on the Blackrock Bitcoin ETF share price will provide valuable insights into the current state of the cryptocurrency market.

This article address:https://www.aichavitalis.com/crypto/10e28499705.html

Like!(8)

Related Posts

- Antminer Bitcoin Mining Rigs: The Ultimate Tool for Cryptocurrency Mining

- What Was the Price of Bitcoin in 2021?

- Fidelity Wise Origin Bitcoin Fund Price: A Comprehensive Analysis

- The Price of Bitcoin in September 2013: A Look Back at the Cryptocurrency's Early Days

- How to Add Binance Smart Chain to Metamask Wallet: A Step-by-Step Guide

- What Happens When You Sell Your Bitcoin on Cash App

- When Binance Will List Luna 2.0: A Comprehensive Analysis

- Zebpay Bitcoin Cash Price: A Comprehensive Analysis

- Ripple Bitcoin Share Price: A Comprehensive Analysis

- The Price of Bitcoin Gold in AUD: A Comprehensive Analysis

Popular

Recent

Binance Smart Chain Metamask Extension: A Game-Changer for Crypto Users

The Best Bitcoin Desktop Wallet: A Comprehensive Guide

How to Send Money from PayPal to Bitcoin Wallet

Online Bitcoin Mining: A Lucrative and Accessible Investment Opportunity

How to Stop Loss on the Binance App: A Comprehensive Guide

How to Set Up Bitcoin Mining Software: A Comprehensive Guide

Wazirx to Binance Coin Transfer: A Comprehensive Guide

Setting Up a Bitcoin Wallet in NY: A Comprehensive Guide

links

- venezuela's economy has been struggling in recent years, with hyperinflation and a lack of access to basic goods and services. in this context, many venezuelans are turning to alternative sources of income, including mining bitcoins. but can i make money mining bitcoins in venezuela? let's explore the potential and challenges of this endeavor.

- How to Convert Bitcoin to Cash in Cash App

- Bitcoin Wallet Icon Free: The Ultimate Guide to Finding the Best Free Bitcoin Wallet Icons

- venezuela's economy has been struggling in recent years, with hyperinflation and a lack of access to basic goods and services. in this context, many venezuelans are turning to alternative sources of income, including mining bitcoins. but can i make money mining bitcoins in venezuela? let's explore the potential and challenges of this endeavor.

- Bitcoin Mining Toronto: The Growing Trend in Cryptocurrency Mining

- Can I Invest Company Money in Bitcoin?

- The Safest Binance Stable Coin: A Comprehensive Guide

- What New Coin Has Been Added to Binance: A Comprehensive Overview

- Check Wallet Balance Bitcoin: A Comprehensive Guide

- **How to Make an Anonymous Bitcoin Wallet: A Comprehensive Guide