You are here:Aicha Vitalis > crypto

The Price of Bitcoin: A Comprehensive Analysis

Aicha Vitalis2024-09-20 23:41:38【crypto】5people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The price of Bitcoin, often referred to as the "price of Bitcoin," has been a topic of great interes airdrop,dex,cex,markets,trade value chart,buy,The price of Bitcoin, often referred to as the "price of Bitcoin," has been a topic of great interes

The price of Bitcoin, often referred to as the "price of Bitcoin," has been a topic of great interest and debate among investors, enthusiasts, and critics alike. As the world's first and most well-known cryptocurrency, Bitcoin has seen its price fluctuate dramatically since its inception in 2009. In this article, we will delve into the factors that influence the price of Bitcoin and explore its current status in the cryptocurrency market.

First and foremost, it is important to understand that the price of Bitcoin is determined by the supply and demand dynamics in the market. As with any other asset, the price of Bitcoin is influenced by the number of people who want to buy it and the number of people who want to sell it. When demand for Bitcoin increases, its price tends to rise, and vice versa. This is a fundamental principle that governs the price of Bitcoin and other cryptocurrencies.

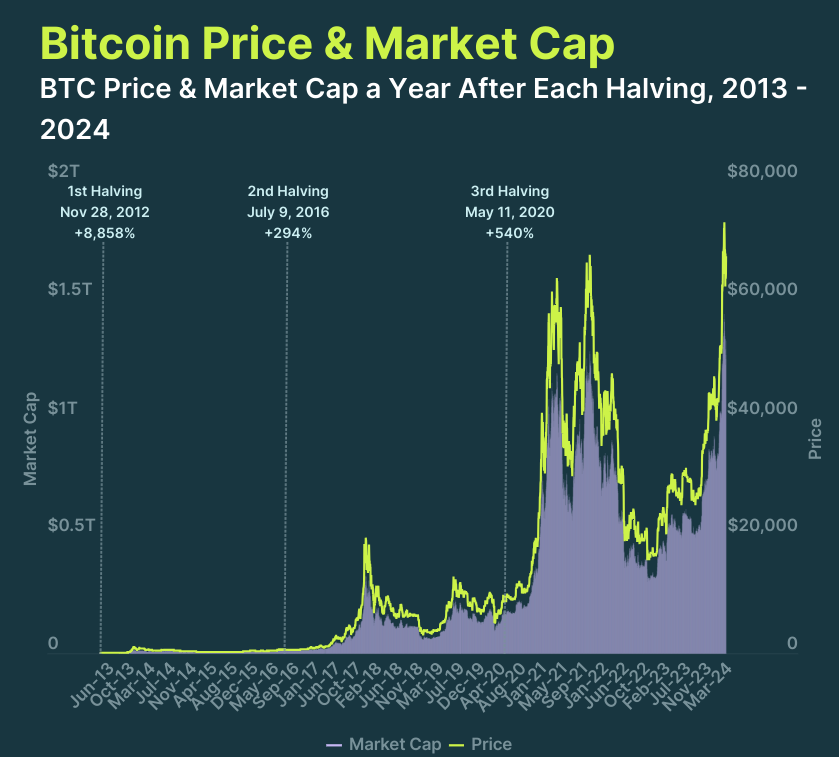

One of the key factors that contribute to the volatility of the price of Bitcoin is its limited supply. Bitcoin has a maximum supply of 21 million coins, which is predetermined by its underlying algorithm. This scarcity has led to a speculative bubble in the price of Bitcoin, as investors and speculators alike anticipate that the limited supply will drive up the price in the long run. As a result, the price of Bitcoin has experienced significant fluctuations over the years, with some periods of rapid growth and others of sharp declines.

Another important factor that affects the price of Bitcoin is the regulatory environment. Governments and financial authorities around the world have varying attitudes towards cryptocurrencies, and this can have a significant impact on the price of Bitcoin. For instance, countries that have implemented strict regulations on the use of cryptocurrencies may see a decrease in demand for Bitcoin, which can lead to a drop in its price. Conversely, countries that have embraced cryptocurrencies and provided a supportive regulatory framework may see an increase in demand for Bitcoin, which can drive up its price.

The price of Bitcoin is also influenced by technological advancements and innovations in the cryptocurrency space. For example, the development of new blockchain technologies and the introduction of new cryptocurrencies can affect the market dynamics and, consequently, the price of Bitcoin. Additionally, the level of adoption of Bitcoin as a payment method can also impact its price. As more businesses and individuals accept Bitcoin as a form of payment, its price may increase due to the growing demand for the cryptocurrency.

In recent years, the price of Bitcoin has experienced a remarkable surge, reaching an all-time high of nearly $69,000 in November 2021. However, it is important to note that the price of Bitcoin is highly speculative and can be influenced by a wide range of factors, including market sentiment, geopolitical events, and technological developments. As such, it is crucial for investors to conduct thorough research and exercise caution when investing in Bitcoin or any other cryptocurrency.

In conclusion, the price of Bitcoin is a complex and multifaceted issue that is influenced by a variety of factors. From supply and demand dynamics to regulatory environments and technological advancements, the price of Bitcoin is subject to significant volatility. As the world continues to navigate the evolving landscape of cryptocurrencies, it is essential for investors to stay informed and make well-informed decisions when considering the price of Bitcoin and other cryptocurrencies.

This article address:https://www.aichavitalis.com/crypto/14a98898997.html

Like!(15)

Related Posts

- What is happening to Bitcoin Cash?

- Binance Smart Chain Network Details: A Comprehensive Overview

- The Largest Bitcoin Mining Operation: A Game-Changing Venture

- Bitcoin Cash and Replay Attacks: A Comprehensive Analysis

- Title: Understanding the Importance of Your Indirizzo Bitcoin Wallet

- Bitcoin Mining App Free: A Comprehensive Guide to Harnessing Cryptocurrency Potential

- Bitcoin Cash Price Surge: What's Behind the Recent Rise?

- How to Send Flappig App Bitcoins to Your Wallet

- Bitcoin Mining Rig with GPU: A Comprehensive Guide

- Does Tim Draper Hold Bitcoin Cash?

Popular

Recent

Can I Buy Bitcoin with BitGo?

Bitcoin vs Binance: The Ultimate Showdown of Cryptocurrency Platforms

How to Receive Money through Bitcoin Wallet: A Comprehensive Guide

The Rise of Hard USDT on Binance: A Game-Changer in the Cryptocurrency Landscape

Bitcoin Cash Value at Inception Date: A Look Back at Its Initial Price and Its Evolution

Bitcoin Wallet Amounts: A Comprehensive Analysis

How to Profit When Bitcoin Price Decreases

How Does Mining Create Bitcoin?

links

- Bitcoin Mining in China and Canada: A Comparative Analysis

- Bitcoin Mining in China and Canada: A Comparative Analysis

- How to Send Bitcoin Using Binance: A Step-by-Step Guide

- Title: How to Buy Bitcoin Cash Near Me: A Comprehensive Guide

- LastPass Bitcoin Wallet: A Secure and Convenient Solution for Cryptocurrency Management

- Binance BTC USD Price: A Comprehensive Analysis

- Bitcoin Cash Hard Fork: Was Ist Das?

- Title: The Convenience of Bitcoin Wallet on Phone: A Modern Financial Solution

- **Putting GTO on Binance Chain: A New Era for the Cryptocurrency Community

- Bitcoin Cash Hard Fork: Was Ist Das?