You are here:Aicha Vitalis > price

Mining for USD Not Bitcoins: The Shift in Cryptocurrency Investment

Aicha Vitalis2024-09-20 22:52:27【price】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In the world of cryptocurrency, mining has long been synonymous with Bitcoin. However, as the market airdrop,dex,cex,markets,trade value chart,buy,In the world of cryptocurrency, mining has long been synonymous with Bitcoin. However, as the market

In the world of cryptocurrency, mining has long been synonymous with Bitcoin. However, as the market evolves, there is a growing trend towards mining for USD not Bitcoin. This shift is driven by several factors, including the increasing difficulty of mining Bitcoin, the rise of alternative cryptocurrencies, and the desire for more stable returns.

Firstly, the difficulty of mining Bitcoin has been on the rise, making it increasingly challenging for individual miners to turn a profit. The process of mining involves solving complex mathematical problems to validate transactions and add new blocks to the blockchain. As more miners join the network, the difficulty of these problems increases, requiring more computing power and energy consumption. This has led to a situation where only the largest and most efficient mining operations can realistically expect to make a profit.

In contrast, mining for USD not Bitcoin offers a more accessible and potentially profitable alternative. There are several cryptocurrencies that can be mined for USD, providing a more stable and predictable income stream. Some of these include Ethereum, Litecoin, and Dogecoin, among others. These cryptocurrencies have lower mining difficulty compared to Bitcoin, making it easier for individual miners to participate and potentially earn a return on their investment.

The rise of alternative cryptocurrencies has also contributed to the shift towards mining for USD not Bitcoin. While Bitcoin remains the most popular and valuable cryptocurrency, there are numerous other digital assets that offer unique features and potential for growth. Mining these alternative cryptocurrencies can provide diversification in an investor's portfolio, as well as the opportunity to benefit from the growth of specific projects.

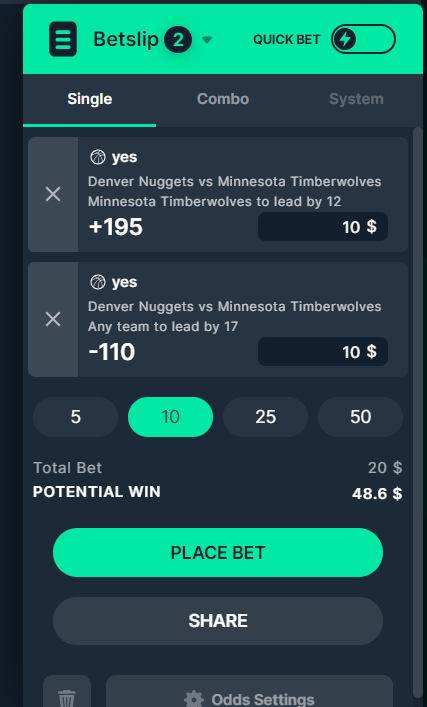

Moreover, the desire for more stable returns is another driving factor behind the shift towards mining for USD not Bitcoin. Bitcoin, while known for its volatility, can be unpredictable in terms of its value. Mining for USD, on the other hand, offers a more stable income stream, as the value of the USD is generally more stable compared to Bitcoin. This can be particularly appealing to investors who are looking for a consistent and reliable source of income.

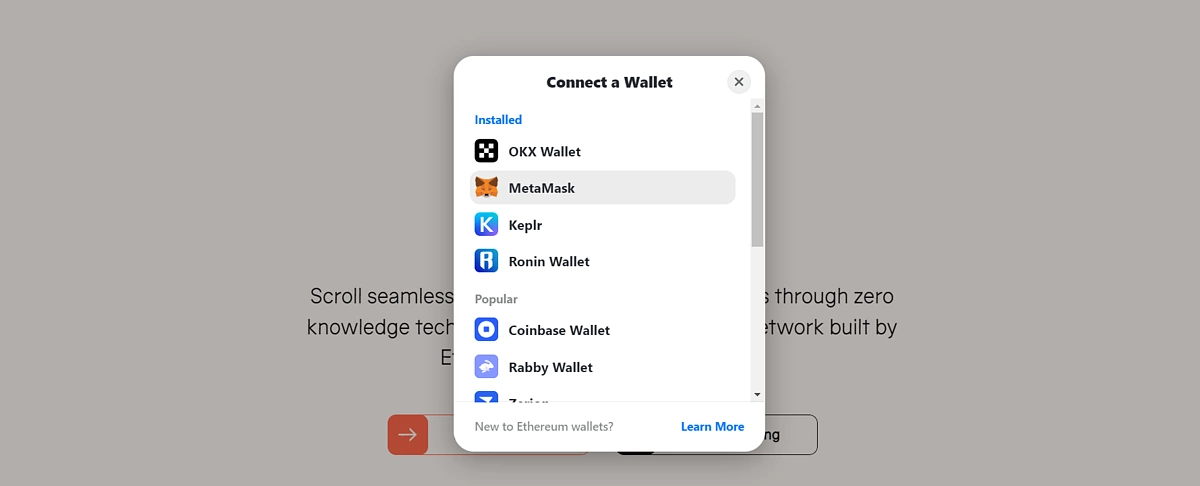

To engage in mining for USD not Bitcoin, investors have several options. They can either purchase their own mining equipment and set up their own mining operation, or they can opt for cloud mining services. Cloud mining allows individuals to rent mining power from a third-party provider, eliminating the need for expensive equipment and the complexities of managing a mining operation.

However, it is important to note that mining for USD not Bitcoin is not without its risks. The value of alternative cryptocurrencies can be highly volatile, and the profitability of mining can fluctuate significantly. Additionally, the energy consumption and costs associated with mining can be substantial, especially for those who choose to mine at home.

In conclusion, the shift towards mining for USD not Bitcoin reflects a changing landscape in the cryptocurrency market. As the difficulty of mining Bitcoin continues to rise, and as investors seek more stable and accessible opportunities, mining alternative cryptocurrencies has become an attractive option. While there are risks involved, the potential for profitability and diversification makes mining for USD not Bitcoin a compelling choice for many investors. As the cryptocurrency market evolves, it will be interesting to see how this trend develops and what new opportunities arise for miners and investors alike.

This article address:https://www.aichavitalis.com/crypto/29b97099000.html

Like!(222)

Related Posts

- Unlocking the World of Free Bitcoin Cash Games: A Gamers' Paradise

- Bitcoin Cash Nano S: The Ultimate Crypto Hardware Wallet for Secure Transactions

- How to Convert Shiba to USDT on Binance: A Step-by-Step Guide

- Creating a Bitcoin Cash Raw Transaction: A Comprehensive Guide

- Step Coin Binance: A Comprehensive Guide to Understanding and Utilizing This Innovative Cryptocurrency Platform

- ChatGPT Predicts Bitcoin Price: A New Era in Cryptocurrency Analysis

- Bitcoin Current Price in INR: A Comprehensive Analysis

- Binance Chain Wallet ERC20: A Comprehensive Guide to Managing Your Digital Assets

- Crypto Best Trading Pairs on Binance: Strategies for Maximizing Returns

- **Pronóstico Bitcoin Cash: The Future Outlook of the Cryptocurrency

Popular

Recent

Binance vs Coinbase Pro Reddit: A Comprehensive Comparison

Bitcoin Gold, a hard fork of Bitcoin that aims to enhance privacy and decentralization, has gained significant traction in the cryptocurrency community. As the demand for Bitcoin Gold grows, so does the need for reliable wallets that can securely store and manage this digital asset. Here's a comprehensive look at some of the wallets supporting Bitcoin Gold.

Who Forked Bitcoin Cash: The Controversial Split in the Cryptocurrency World

### Uniswap Coin on Binance: A Comprehensive Guide

Connecting Metamask to Binance Smart Chain: A Comprehensive Guide from Binance Academy

Difference Between Bitcoin Cash and Bitcoin Gold

**Understanding the Ledger Nano Bitcoin Cash Address: A Comprehensive Guide

Title: Navigating the Transition: Sending LTC to Bitcoin Cash Address

links

- **The Rise of Wallet Chivo Bitcoin: A Game-Changer in Cryptocurrency Storage

- Bitcoin's Price History: A Journey Through Time

- Raspberry Pi as Bitcoin Wallet: A Comprehensive Guide

- **Intel HD Graphics 4600 Bitcoin Mining: A Comprehensive Guide

- Can You Deposit Bitcoin into PayPal?

- How Is Bitcoin Cash Different from Bitcoin?

- IQ Bitcoin Mining: The Future of Cryptocurrency Extraction

- Bitcoin Lawyer Canada: Navigating the Legal Landscape of Cryptocurrency

- ### Understanding the Concept of Transfer Bitcoin Wallet Mnemonic No Balance

- How Does Mining Bitcoin Make Money?