You are here:Aicha Vitalis > price

Bitcoin Price Guide: Understanding the Volatile Market

Aicha Vitalis2024-09-20 23:37:13【price】6people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the year

Bitcoin, the world's first decentralized cryptocurrency, has gained immense popularity over the years. As the digital currency continues to evolve, many individuals and investors are eager to understand its price dynamics. This article serves as a comprehensive Bitcoin Price Guide, providing insights into the factors influencing the market and strategies for navigating its volatility.

What is Bitcoin?

Bitcoin is a digital or virtual currency that uses cryptography to secure transactions and control the creation of new units. Unlike traditional fiat currencies, Bitcoin operates independently of any central authority, making it a decentralized currency. Its supply is capped at 21 million coins, which adds to its scarcity and potential value.

Understanding Bitcoin Price Guide

The Bitcoin Price Guide is a valuable tool for anyone interested in the cryptocurrency market. It provides a snapshot of the current price, historical data, and predictions for future trends. Here's a breakdown of the key components of the Bitcoin Price Guide:

1. Current Price: The current price of Bitcoin is a crucial factor in the Bitcoin Price Guide. It reflects the market's perception of its value at any given time. The price is typically displayed in various fiat currencies, such as USD, EUR, and JPY.

2. Historical Data: Historical data in the Bitcoin Price Guide helps investors understand the market's past performance. By analyzing historical trends, one can identify patterns and potential future price movements. This data is often presented in the form of charts and graphs, making it easier to visualize the price fluctuations over time.

3. Market Cap: The market cap of Bitcoin represents the total value of all Bitcoin in circulation. It is calculated by multiplying the current price by the total number of coins in circulation. The market cap is a vital indicator of Bitcoin's overall value and its position in the cryptocurrency market.

4. Volatility: Bitcoin is known for its high volatility, which is a significant factor in the Bitcoin Price Guide. The price of Bitcoin can experience rapid and dramatic changes within a short period. Understanding this volatility is crucial for making informed investment decisions.

Factors Influencing Bitcoin Price

Several factors influence the price of Bitcoin, and it's essential to consider these in the Bitcoin Price Guide:

1. Supply and Demand: The supply of Bitcoin is capped at 21 million coins, while the demand for the cryptocurrency can fluctuate based on various factors, such as market sentiment, regulatory news, and technological advancements.

2. Market Sentiment: The perception of Bitcoin's value among investors and traders can significantly impact its price. Positive news, such as increased adoption or regulatory support, can drive the price up, while negative news can lead to a decline.

3. Economic Factors: Economic conditions, such as inflation, interest rates, and currency fluctuations, can influence the price of Bitcoin. As a digital asset, Bitcoin is often seen as a hedge against traditional financial systems.

4. Technological Developments: Innovations and improvements in blockchain technology can impact the price of Bitcoin. For example, the successful implementation of the Lightning Network can enhance Bitcoin's scalability and utility, potentially increasing its value.

Navigating Bitcoin Price Volatility

As a Bitcoin Price Guide, it's crucial to understand that navigating the volatile market requires careful planning and risk management. Here are some strategies to consider:

1. Diversify Your Portfolio: Diversifying your investment across various cryptocurrencies and assets can help mitigate risks associated with Bitcoin's volatility.

2. Conduct Thorough Research: Stay informed about market trends, news, and technological advancements to make informed investment decisions.

3. Set Realistic Goals: Define clear investment goals and risk tolerance levels to avoid making impulsive decisions based on short-term market fluctuations.

4. Use Stop-Loss Orders: Implement stop-loss orders to limit potential losses in case the price of Bitcoin falls below a certain level.

In conclusion, the Bitcoin Price Guide is an essential tool for understanding the cryptocurrency market. By analyzing the current price, historical data, market cap, and factors influencing the price, investors can make informed decisions and navigate the volatile market effectively. Remember to stay informed, diversify your portfolio, and manage risks to achieve long-term success in the Bitcoin market.

This article address:https://www.aichavitalis.com/crypto/48a98098971.html

Like!(114)

Related Posts

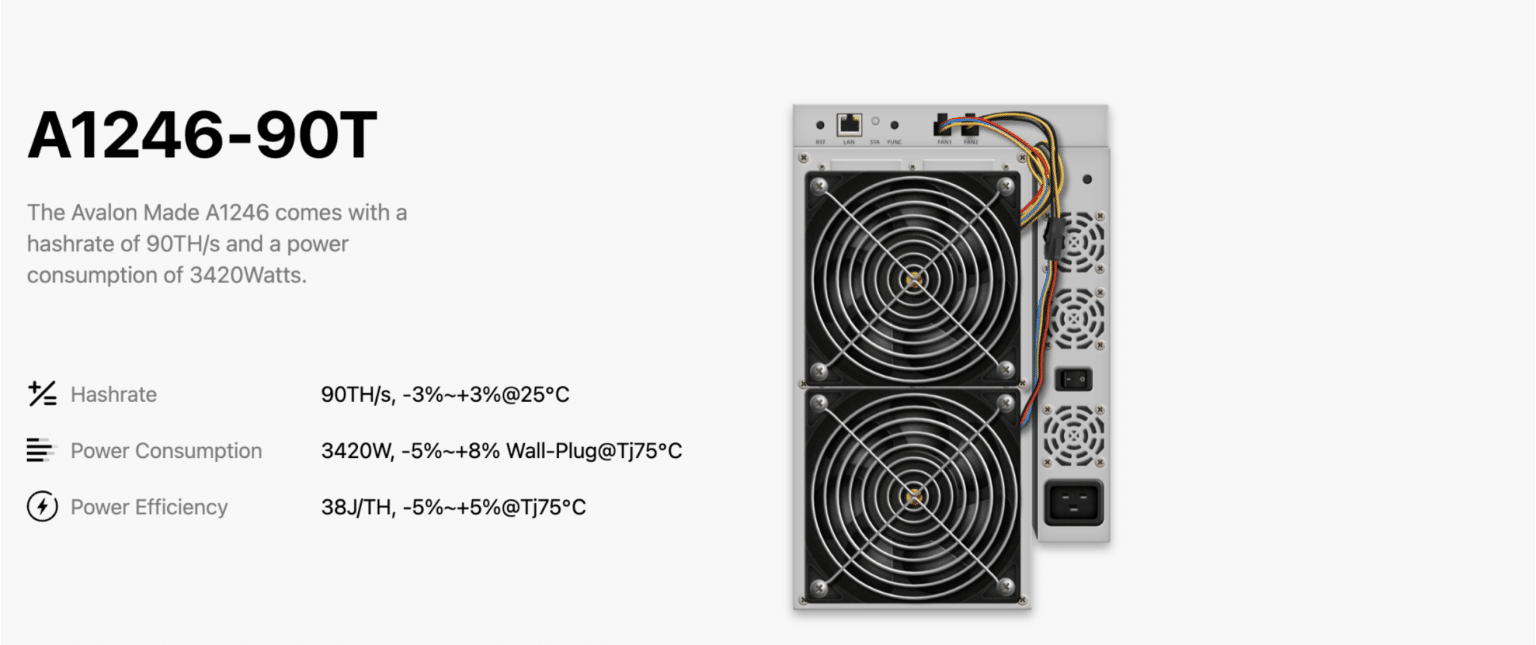

- Is Bitcoin Mining a Lucrative Venture?

- Bitcoin Price Fundamentals: Understanding the Underlying Factors Influencing Cryptocurrency Value

- Current Bitcoin Price UK: Trends and Predictions

- Binance Price Filter: A Game-Changing Tool for Cryptocurrency Traders

- **Stack Overflow Bitcoin Mining Algorithm: A Comprehensive Guide

- Bitcoin Price Chart 2024: A Comprehensive Analysis

- Which Sites Support Bitcoin Cash?

- How to Withdraw to Binance: A Step-by-Step Guide

- Title: Enhancing Your Crypto Trading Strategy with the Binance Average Price Calculator

- Can U Cash Out Bitcoin: A Comprehensive Guide

Popular

Recent

Bitcoin Price Last 60 Days: A Comprehensive Analysis

Bitcoin Cloud Mining Introduction

Binance Price Filter: A Game-Changing Tool for Cryptocurrency Traders

Instagram Bitcoin Mining Hack: How Cybercriminals Are Exploiting Social Media Platforms

Why Is the Price of Bitcoin Different Between Exchanges?

What is the Withdrawal Address on Binance?

Raspberry Pi Mining Bitcoins: A Cost-Effective Solution for Crypto Enthusiasts

Bitcoin Price Graph 2023: A Comprehensive Analysis

links

- Wanna Cry Ransomware Bitcoin Wallet: A Closer Look at the Cryptocurrency Connection

- When is the Binance Coin Burn 2018?

- Can Bitcoin Algorithm Be Changed?

- No Price Target Major Bitcoin Investor Embraces the Cryptocurrency's Potential

- How to Transfer SHIB from Binance to Coinbase: A Step-by-Step Guide

- SEC Sues Binance and Coinbase: A Major Legal Battle in the Cryptocurrency Industry

- Is Cash App Out of Bitcoin: What You Need to Know

- Can I Store 1 Bitcoin on Exodus?

- How to Sell Binance Smart Chain Tokens: A Comprehensive Guide

- Bitcoin Gold Price USD: A Comprehensive Analysis