You are here:Aicha Vitalis > news

Bitcoin Price Charts in INR: A Comprehensive Analysis

Aicha Vitalis2024-09-20 21:38:47【news】0people have watched

Introductioncrypto,coin,price,block,usd,today trading view,Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the ye airdrop,dex,cex,markets,trade value chart,buy,Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the ye

Bitcoin, the world's first decentralized digital currency, has gained immense popularity over the years. Its value has seen significant fluctuations, making it a highly sought-after asset for investors and traders. One of the most important aspects of Bitcoin investment is keeping track of its price. In this article, we will delve into the Bitcoin price charts in INR, providing a comprehensive analysis of the currency's performance in the Indian market.

Bitcoin Price Charts in INR: Understanding the Market

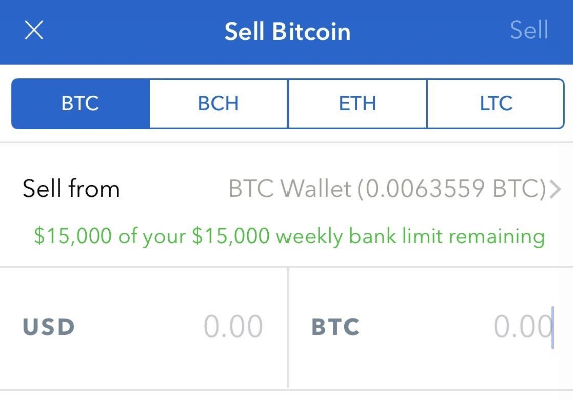

Bitcoin price charts in INR are essential tools for investors and traders to gauge the market's sentiment and make informed decisions. These charts display the historical price of Bitcoin in Indian Rupees, allowing users to analyze trends, patterns, and potential future movements.

The Bitcoin price charts in INR show that the cryptocurrency has experienced a rollercoaster ride since its inception in 2009. Initially, Bitcoin was valued at a few cents, but it quickly surged to thousands of dollars. However, it has also faced several corrections and bear markets, leading to a volatile market.

Bitcoin Price Charts in INR: Historical Performance

To understand the Bitcoin price charts in INR, let's take a look at its historical performance. In 2017, Bitcoin reached an all-time high of around Rs. 9 lakhs. However, it faced a major correction in 2018, plummeting to Rs. 40,000. The year 2019 saw a gradual recovery, with Bitcoin trading in the range of Rs. 80,000 to Rs. 1 lakh. In 2020, the cryptocurrency experienced another bull run, reaching an all-time high of Rs. 15 lakhs.

The Bitcoin price charts in INR have shown that the cryptocurrency is highly sensitive to global market trends, regulatory news, and technological advancements. For instance, the Reserve Bank of India's (RBI) ban on banks dealing with cryptocurrency exchanges led to a significant drop in Bitcoin prices in India.

Bitcoin Price Charts in INR: Factors Influencing the Market

Several factors influence the Bitcoin price charts in INR. Here are some of the key factors:

1. Global Market Trends: The performance of Bitcoin in the global market has a direct impact on its price in India. For instance, when Bitcoin surges in the US, it tends to rise in the Indian market as well.

2. Regulatory News: Any news related to cryptocurrency regulations in India can significantly impact the Bitcoin price charts in INR. For instance, the RBI's ban on banks dealing with cryptocurrency exchanges led to a drop in Bitcoin prices.

3. Technological Advancements: Innovations in blockchain technology and the development of new Bitcoin mining technologies can influence the price charts in INR.

4. Market Sentiment: The overall sentiment of investors and traders towards Bitcoin can lead to significant price movements. For instance, a positive sentiment can lead to a bull run, while a negative sentiment can trigger a bear market.

Bitcoin Price Charts in INR: Future Outlook

The future of Bitcoin price charts in INR remains uncertain. While some experts believe that Bitcoin will continue to rise in value, others predict a potential bubble that could burst. However, one thing is certain: Bitcoin will continue to be a highly volatile asset, making it crucial for investors and traders to stay informed and keep an eye on the price charts in INR.

In conclusion, Bitcoin price charts in INR are essential tools for investors and traders to analyze the market and make informed decisions. By understanding the historical performance, factors influencing the market, and future outlook, one can better navigate the volatile world of Bitcoin investment.

This article address:https://www.aichavitalis.com/crypto/60f7299867.html

Like!(583)

Related Posts

- EFT Bitcoin Price: The Latest Trends and Predictions

- How to Get Bitcoin Wallet Address on Coinbase: A Step-by-Step Guide

- Uphold Bitcoin Cash: A Secure and Convenient Way to Invest in Cryptocurrency

- NFT Tokens Listed on Binance: A New Era of Digital Collectibles

- Can Bitcoin Be Exchanged for US Dollars?

- Mark a Bitcoin Wallet as Malicious: A Comprehensive Guide to Protecting Your Cryptocurrency

- Can You Buy Actual Bitcoins?

- Can I Make a Binance Account in the US?

- Unlocking the Future of Cryptocurrency: The Bitcoin Mining Robot App Revolution

- How to Find My Bitcoin Wallet: A Comprehensive Guide

Popular

Recent

Which Bitcoin Wallet Is Available in Egypt: A Comprehensive Guide

Why Can't I See Binance Balances? A Comprehensive Guide

Why Are Bitcoin Mining Stocks Going Down?

How to Create a Bitcoin Wallet App: A Step-by-Step Guide

What Was the Price of Bitcoin in 2009 Year?

Why Can't I See Binance Balances? A Comprehensive Guide

Why Does Bitcoin Mining Take So Much Energy?

Which Coins Can Be Staked on Binance: A Comprehensive Guide

links

- Binance You Temporarily Can't Withdraw: Understanding the Situation and What to Do

- How to Put Money in a Bitcoin Wallet: A Step-by-Step Guide

- Best Bitcoin Wallet for Android in India: A Comprehensive Guide

- Lowest Price of Bitcoin in 2019: A Look Back at the Cryptocurrency's Price Volatility

- The First Bitcoin Wallet on iPhone: A Game-Changer for Cryptocurrency Users

- How to Find Binance from Coinbase: A Comprehensive Guide

- Unlocking the Potential of Bitcoin Mining: The Power of Bitcoin Mining Calculator and Profitability Calculator

- Bitcoin Test Wallet: A Comprehensive Guide to Testing Your Bitcoin Transactions

- What Was the First Price of Bitcoin?

- Bitcoin Price Prediction for End of September 2021: What to Expect?