You are here:Aicha Vitalis > bitcoin

Bitcoin Gold Price Investing: A Comprehensive Guide

Aicha Vitalis2024-09-20 21:28:05【bitcoin】4people have watched

Introductioncrypto,coin,price,block,usd,today trading view,In recent years, the cryptocurrency market has witnessed a surge in popularity, with Bitcoin being t airdrop,dex,cex,markets,trade value chart,buy,In recent years, the cryptocurrency market has witnessed a surge in popularity, with Bitcoin being t

In recent years, the cryptocurrency market has witnessed a surge in popularity, with Bitcoin being the most prominent digital currency. However, Bitcoin Gold (BTG) has emerged as a viable alternative, attracting investors looking for a different investment opportunity. This article aims to provide a comprehensive guide on Bitcoin Gold price investing, covering its background, market dynamics, and investment strategies.

Bitcoin Gold (BTG) was launched in 2017 as a fork of Bitcoin, aiming to address some of the issues that Bitcoin faced. The primary goal of Bitcoin Gold was to introduce a more decentralized mining process, making it more accessible to individual miners. By implementing the Equihash algorithm, Bitcoin Gold made mining more GPU-friendly, which allowed smaller players to participate in the mining process.

The market dynamics of Bitcoin Gold are quite similar to those of Bitcoin. The price of BTG is influenced by various factors, including market sentiment, technological advancements, regulatory news, and macroeconomic conditions. Like Bitcoin, Bitcoin Gold has experienced periods of volatility, making it a risky yet potentially lucrative investment.

When considering Bitcoin Gold price investing, it is crucial to understand the following aspects:

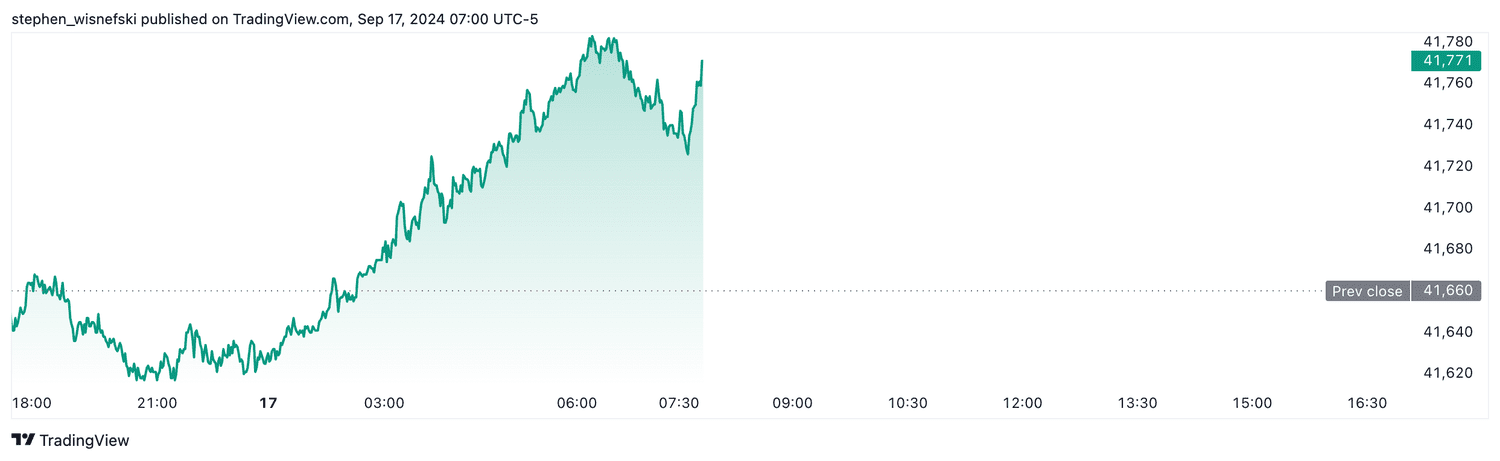

1. Market Analysis: Before investing in Bitcoin Gold, it is essential to conduct thorough market analysis. This involves studying the historical price trends, market capitalization, trading volume, and liquidity. Analyzing these factors can help you understand the current market sentiment and predict future price movements.

2. Technical Analysis: Technical analysis involves studying past price movements and trading volume to predict future price trends. By analyzing various technical indicators, such as moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence), you can gain insights into the potential price movements of Bitcoin Gold.

3. Fundamental Analysis: Fundamental analysis focuses on the intrinsic value of Bitcoin Gold by examining factors such as its adoption rate, mining difficulty, and technological advancements. Understanding these factors can help you assess the long-term potential of BTG as an investment.

4. Risk Management: As with any investment, it is crucial to manage your risks. Determine the amount of capital you are willing to allocate to Bitcoin Gold and set stop-loss and take-profit levels to minimize potential losses. Diversifying your investment portfolio can also help mitigate risks.

5. Investment Strategies: There are several investment strategies you can adopt when investing in Bitcoin Gold:

a. Long-term holding: If you believe in the long-term potential of Bitcoin Gold, you can invest in it and hold it for an extended period. This strategy requires patience and a strong belief in the cryptocurrency's future.

b. Swing trading: Swing trading involves buying and selling Bitcoin Gold within a short to medium-term timeframe. This strategy requires you to be more active in monitoring the market and making timely decisions.

c. Day trading: Day trading is a high-risk, high-reward strategy that involves buying and selling Bitcoin Gold within a single trading day. This strategy requires excellent market analysis skills and a quick decision-making process.

In conclusion, Bitcoin Gold price investing can be a lucrative opportunity for those willing to take on the risks associated with the cryptocurrency market. By understanding the market dynamics, conducting thorough analysis, and adopting a sound investment strategy, you can increase your chances of success. However, it is crucial to remember that investing in cryptocurrencies carries inherent risks, and you should never invest more than you can afford to lose.

This article address:https://www.aichavitalis.com/crypto/65f9999835.html

Like!(87397)

Related Posts

- Title: Convert Bitcoin to Cash in Malaysia: A Comprehensive Guide

- Binance KNC BTC: A Comprehensive Guide to Understanding the Cryptocurrency Pair

- Bitcoin Wallets Online: The Ultimate Guide to Secure Digital Asset Storage

- Coinbase Bitcoin Sell Price: What You Need to Know

- Can I Buy Telcoin on Binance?

- Bitcoin Wallets Online: The Ultimate Guide to Secure Digital Asset Storage

- What Are the Bitcoin Mining Pools?

- Can Bitcoin Miners Mine Dogecoin?

- Bitcoin Cash Frozen: The Impact on the Cryptocurrency Market

- Can I Send USDT from Binance to Metamask?

Popular

Recent

Yesterday Bitcoin Price: A Look Back at the Market Movement

The Future of Bitcoin: Can the Price Continue to Soar?

The Rise of Eternity Chain Binance: A Game-Changer in the Crypto World

Sweatcoin Bitcoin Mining: A Revolutionary Concept for Health and Wealth

Can I Use a Prepaid Card to Buy Bitcoin?

Is Binance Going to List Safemoon?

Which is Best: Binance or Coinbase?

The Rise of BTC USD Futures on Binance: A Game-Changer in Cryptocurrency Trading

links

- Can I Buy Bitcoin Using a Credit Card?

- How to Send Money Over Bitcoin Wallet

- Can I Buy Bitcoin Using a Credit Card?

- Bitcoin vs Bitcoin Cash Investment: Which is the Better Choice?

- Title: Finding the Right Address for Your Bitcoin Cash App: A Comprehensive Guide

- How to Send Money Over Bitcoin Wallet

- Bitcoin Price Rupee: The Current State and Future Prospects

- **Screenshot of Bitcoin Wallet: A Closer Look at Cryptocurrency Management

- Bitcoin Mining with Google Chrome: A Beginner's Guide

- Bitcoin Mining Program Download: A Comprehensive Guide to Starting Your Cryptocurrency Journey