You are here:Aicha Vitalis > airdrop

### The 2020 Halving of Bitcoin Price: A Pivotal Moment in Cryptocurrency History

Aicha Vitalis2024-09-20 22:54:26【airdrop】9people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The year 2020 marked a significant event in the cryptocurrency world with the 2020 halving of Bitcoi airdrop,dex,cex,markets,trade value chart,buy,The year 2020 marked a significant event in the cryptocurrency world with the 2020 halving of Bitcoi

The year 2020 marked a significant event in the cryptocurrency world with the 2020 halving of Bitcoin price. This event, which occurred on May 11, 2020, had a profound impact on the value of Bitcoin and the broader cryptocurrency market. The 2020 halving of Bitcoin price is often considered a pivotal moment, as it has the potential to reshape the future of digital currencies.

### Understanding the Halving Event

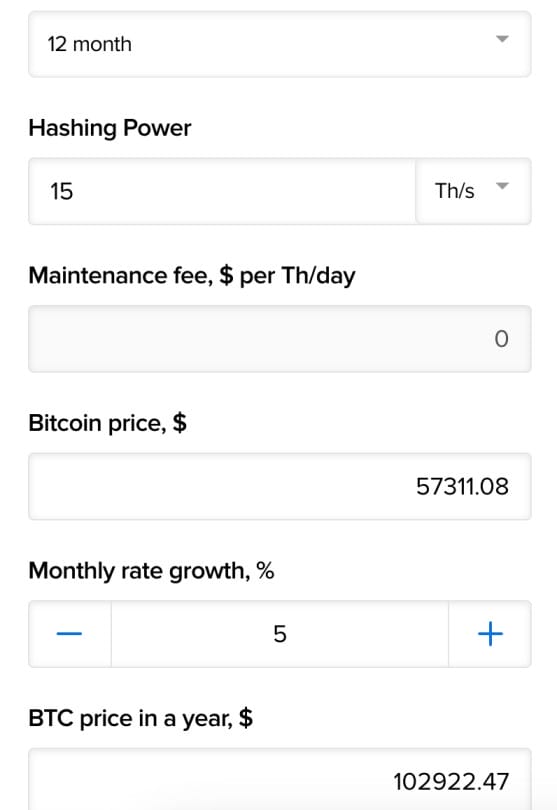

The 2020 halving of Bitcoin price refers to the process by which the reward for mining a new block of Bitcoin is halved. This event happens approximately every four years and is a fundamental feature of the Bitcoin protocol. The reward for mining a block was reduced from 12.5 Bitcoin to 6.25 Bitcoin. This reduction in reward is designed to mimic the scarcity of physical gold and silver, which has historically driven up their value.

### The Immediate Impact

The immediate impact of the 2020 halving of Bitcoin price was a surge in the value of the cryptocurrency. As the reward for mining decreased, the supply of new Bitcoin entering the market also decreased. This reduction in supply, coupled with the ongoing demand for Bitcoin, led to a significant increase in its price. In the days following the halving, Bitcoin's price skyrocketed, reaching an all-time high of nearly $60,000.

### Long-Term Implications

The long-term implications of the 2020 halving of Bitcoin price are still unfolding. Many experts believe that this event could lead to a sustained increase in the value of Bitcoin over the long term. The halving is seen as a catalyst for Bitcoin's adoption as a store of value, similar to gold or silver.

### Market Speculation

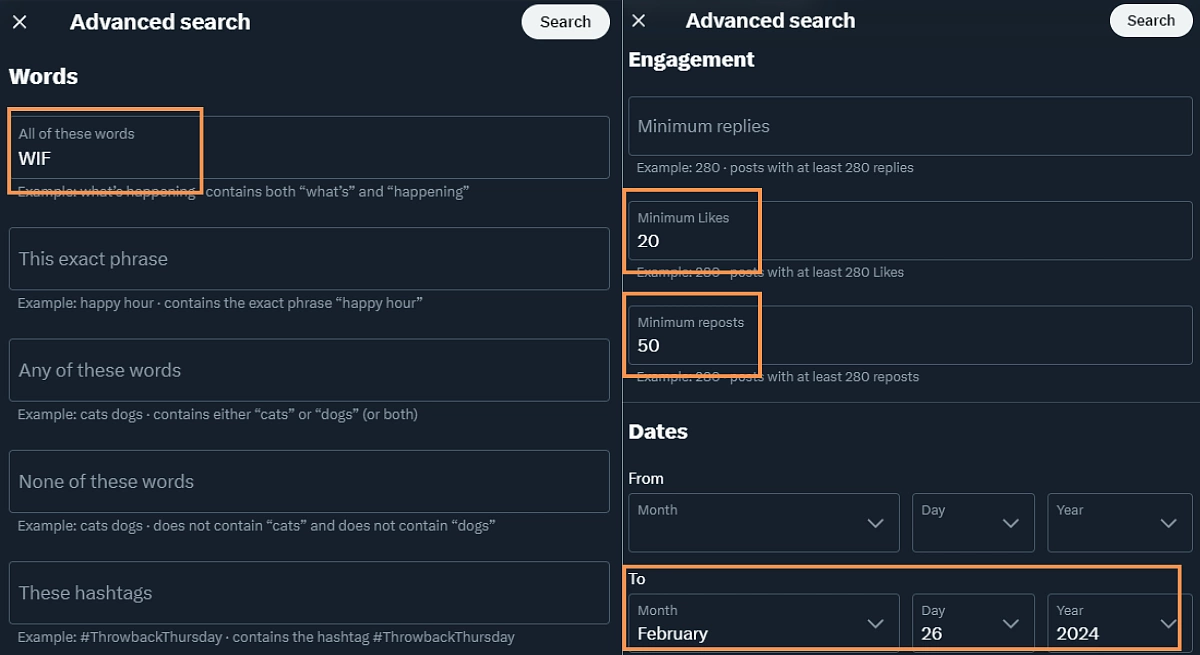

The 2020 halving of Bitcoin price also fueled a wave of speculation in the market. Investors and traders alike predicted that the event would lead to a significant increase in Bitcoin's price. This speculation was further fueled by the global economic uncertainty caused by the COVID-19 pandemic, which led many to seek alternative investments, including cryptocurrencies.

### Broader Cryptocurrency Market

The 2020 halving of Bitcoin price had a ripple effect on the broader cryptocurrency market. Many altcoins experienced increased trading volumes and price surges, as investors sought to capitalize on the broader market trends. However, it's important to note that while Bitcoin remains the largest and most influential cryptocurrency, the market is becoming increasingly diverse.

### The Role of Technology

The 2020 halving of Bitcoin price also highlighted the importance of blockchain technology. As Bitcoin's value increased, so did the interest in blockchain technology as a whole. This has led to increased research and development in the field, with many companies and startups exploring new ways to leverage blockchain for various applications.

### Conclusion

The 2020 halving of Bitcoin price was a pivotal moment in the history of cryptocurrencies. It marked a significant reduction in the supply of new Bitcoin, which, in turn, led to a surge in its price. While the immediate impact was a surge in value, the long-term implications are still unfolding. The event has underscored the importance of Bitcoin as a digital asset and has further solidified its position as a key player in the global financial landscape. As we move forward, the 2020 halving of Bitcoin price will undoubtedly be remembered as a defining moment in the evolution of digital currencies.

This article address:https://www.aichavitalis.com/crypto/69d17199759.html

Like!(1)

Related Posts

- The S Fox Bitcoin Wallet: A Comprehensive Guide to Secure Cryptocurrency Management

- Why Isn't Bitcoin Cash Going Up?

- Is It Easy to Make a Bitcoin Wallet from Scratch?

- Binance Smart Chain Contracts: Revolutionizing the Future of Blockchain Technology

- Bitcoin Price 100K: A Milestone on the Cryptocurrency's Journey

- **The Rise of Managed Bitcoin Mining: A Game-Changer for Investors

- Is It Easy to Make a Bitcoin Wallet from Scratch?

- Binance New Coin Listed on Binance: A Game-Changing Addition to the Platform

- Will Bitcoin Cash Reach All-Time High?

- Bitcoin Cash 100k: A Bold Vision for the Future of Cryptocurrency

Popular

Recent

How to Increase My Cash App Bitcoin Withdrawal Limit: A Comprehensive Guide

Secure Wallet-Assisted Offline Bitcoin Payments with Double-Spender Revocation: A Comprehensive Analysis

Title: A Comprehensive Guide to the Fastest Bitcoin Mining Application

Title: How to Download and Use the https btc miner net download bitcoin miner mining software for Bitcoin Mining

Binance Export Complete Trade History Range: A Comprehensive Guide

Transfer to Bitcoin Wallet: A Comprehensive Guide

Best Bitcoin Wallet 2015 iPhone: The Ultimate Guide to Secure Cryptocurrency Storage

Making Bitcoins Without Mining: A New Era in Cryptocurrency

links

- Why Is Bitcoin Price Different on Exchanges?

- Binance iOS App Download 2019: A Comprehensive Guide

- Ubuntu and Bitcoin Mining: A Comprehensive Guide

- Download Bitcoin Wallet for Android: A Comprehensive Guide

- Wattum Bitcoin Mining: Revolutionizing the Cryptocurrency Mining Industry

- What Bitcoin Mining Pool for ASIC: A Comprehensive Guide

- The Rising Star of Cryptocurrency: XVG BTC Binance

- What Software is Used for Bitcoin Mining?

- Bitcoin Mining Rechner Kaufen: A Comprehensive Guide to Choosing the Right Bitcoin Mining Rig

- How Do I Protect Bitcoin in My Blockchain Wallet?