You are here:Aicha Vitalis > airdrop

What Will the Bitcoin Halving Do to the Price?

Aicha Vitalis2024-09-20 23:28:05【airdrop】8people have watched

Introductioncrypto,coin,price,block,usd,today trading view,The cryptocurrency market has been buzzing with anticipation as the much-anticipated Bitcoin halving airdrop,dex,cex,markets,trade value chart,buy,The cryptocurrency market has been buzzing with anticipation as the much-anticipated Bitcoin halving

The cryptocurrency market has been buzzing with anticipation as the much-anticipated Bitcoin halving event approaches. Bitcoin enthusiasts and investors are curious to know what the Bitcoin halving will do to the price. In this article, we will explore the potential impact of the Bitcoin halving on the price and discuss the various factors that could influence it.

Firstly, let's understand what the Bitcoin halving is. The Bitcoin halving is an event that occurs approximately every four years, where the reward for mining a new block is halved. This event is programmed into the Bitcoin protocol and is designed to control the supply of Bitcoin. As a result, the halving is expected to have a significant impact on the price of Bitcoin.

One of the primary reasons why the Bitcoin halving is expected to affect the price is the reduction in the supply of new Bitcoin. Currently, miners are rewarded with 12.5 Bitcoin for every block they mine. After the halving, this reward will be reduced to 6.25 Bitcoin. This reduction in supply could lead to an increase in the price of Bitcoin, as there will be fewer new coins entering the market.

However, the impact of the Bitcoin halving on the price is not guaranteed to be positive. There are several factors that could influence the outcome. One of the most significant factors is the demand for Bitcoin. If the demand for Bitcoin remains strong, the price is likely to increase. Conversely, if the demand weakens, the price could decline.

Another factor to consider is the overall sentiment in the cryptocurrency market. The Bitcoin halving has historically been a bullish event for the market. However, the sentiment could change if there are negative news or developments in the market. For instance, regulatory news or a significant security breach could lead to a sell-off and a decline in the price.

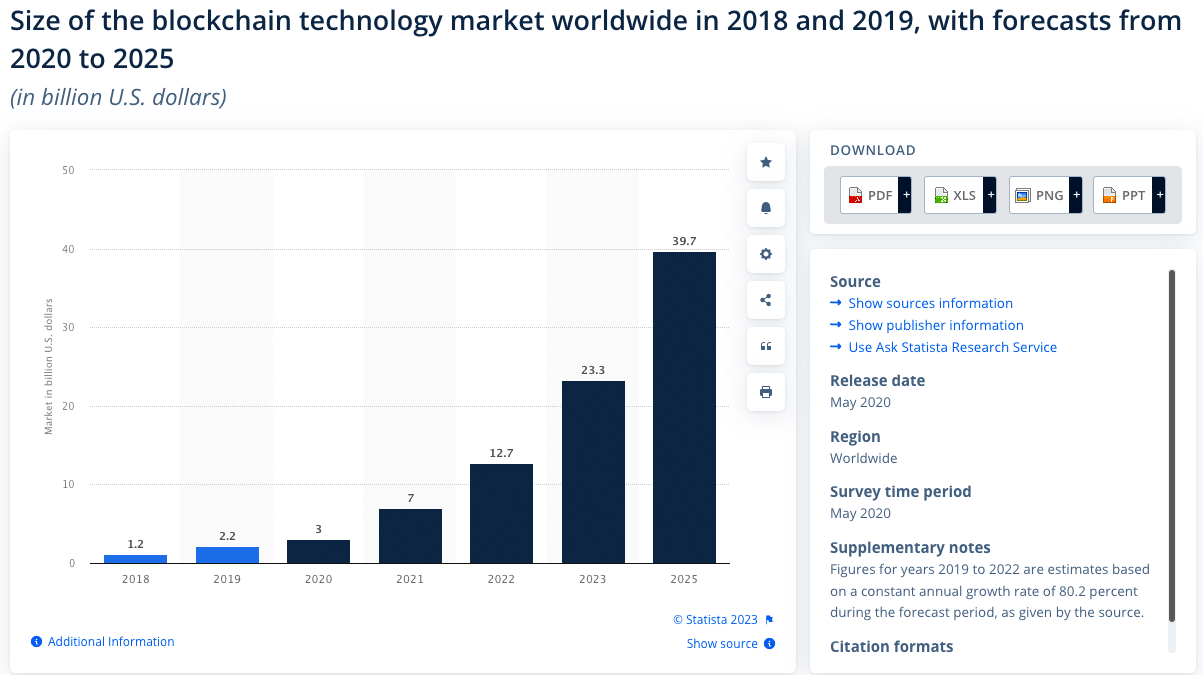

Moreover, the timing of the Bitcoin halving could also play a role in its impact on the price. The event is scheduled to occur in May 2020, which is a period when the market is typically volatile. If the market is already bearish, the Bitcoin halving could exacerbate the downward trend. Conversely, if the market is bullish, the event could provide a catalyst for further growth.

It is also important to note that the Bitcoin halving is not the only factor that could influence the price of Bitcoin. Other factors, such as technological advancements, adoption by institutional investors, and macroeconomic conditions, could also play a significant role.

In conclusion, the Bitcoin halving is an event that is expected to have a significant impact on the price of Bitcoin. While the reduction in supply could lead to an increase in the price, the actual outcome will depend on various factors, including demand, market sentiment, and other external factors. As the event approaches, it is crucial for investors to stay informed and consider the potential risks and opportunities associated with the Bitcoin halving.

In summary, what will the Bitcoin halving do to the price? The answer is not straightforward, as it depends on a multitude of factors. However, the event is likely to have a substantial impact on the price of Bitcoin, and investors should be prepared for potential volatility in the market. Only time will tell whether the Bitcoin halving will lead to a bull run or a bear market, but one thing is certain: the event will be a pivotal moment in the history of Bitcoin and the cryptocurrency market as a whole.

This article address:https://www.aichavitalis.com/crypto/77f96498958.html

Like!(45)

Related Posts

- How to Transfer Bitcoin from Coinbase to Wallet

- Search Bitcoin Cash: A Comprehensive Guide to Understanding and Utilizing This Cryptocurrency

- The Red Pulse Binance Chain: A Game-Changing Blockchain Solution

- Where Can I Buy Bitcoin in Canada: A Comprehensive Guide

- Why Binance Coin is Growing

- The Owner of Bitcoin Wallet: A Key Player in the Cryptocurrency Revolution

- Is Bitcoin Mining a Good Investment?

- Where Can I Buy Bitcoin in Canada: A Comprehensive Guide

- Bitclub Bitcoin Cloud Mining: A Comprehensive Guide to the World of Cryptocurrency Investment

- WIF Binance Listing: A Game-Changer for Cryptocurrency Investors

Popular

Recent

When Was Bitcoin Cash Split: A Comprehensive Look at the Event

Bitcoin Code Canada Scam: Unveiling the Truth Behind the Cryptocurrency Fraud

The Enigma of Crypto Wodl Binance Answer 6 Letters Today

Bitcoin Price of May 2018: A Look Back at the Cryptocurrency's Volatile Journey

FPGA Based Bitcoin Mining Free Circuit: A Comprehensive Guide

Bitcoin Price Prediction This Week 2025: What to Expect

Tracking a Bitcoin Wallet Address: A Comprehensive Guide

Quid Pro Cash or Bitcoin: The Future of Transactions

links

- Can You Buy Things Online with Bitcoin?

- The Rise of Binance, Crypto.com, and Coinbase: A Comprehensive Analysis

- Gemini Bitcoin to Wallet: A Comprehensive Guide

- How to Update Bitcoin-Wallet to 4.3.1: A Comprehensive Guide

- The Current Status of 1 Bitcoin Price in US Dollars

- How to Withdraw Cash from Binance to Bank Account: A Step-by-Step Guide

- Bitcoin Price Hike Today: A Glimpse into the Cryptocurrency's Volatile Market

- What Was the Price of Bitcoin in 2000?

- Understanding the Binance Withdrawal Fee Structure

- The Current Status of 1 Bitcoin Price in US Dollars